Todd's Take

Getting Perspective on 2024 New-Crop Corn Prices

On Thursday, April 18, 2024, December corn closed at $4.60 a bushel, near its lowest level of the past three years. Over the past 50 years, there have been eight times when the price of December corn was this high in April. But of course, the value of a dollar has changed a lot in 50 years. Nothing stays the same.

That has been especially true for the past four years. In 2020, COVID-19 arrived and turned the world upside down. Many of us stayed close to home and gasoline demand plummeted. 2020 will long be remembered as the year in which the price of crude oil fell to -$40.32 a barrel, a price many of us never thought we'd see in our lifetimes. Later in 2020, DTN's U.S. average price of anhydrous hit a low of $422 a ton, then soared to over $1,500 a ton by the spring of 2022, a price we hoped we'd never see.

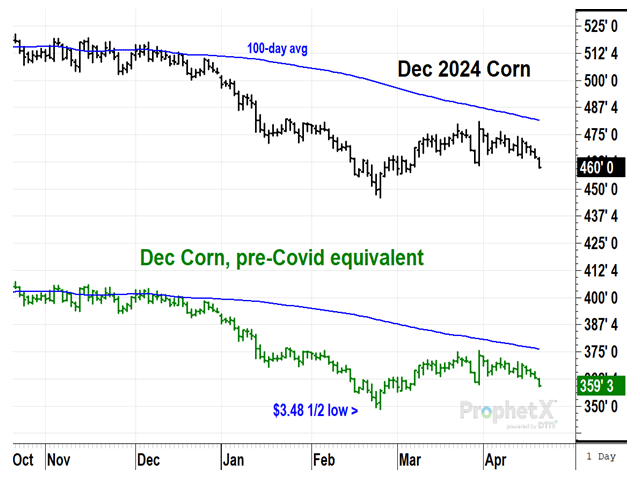

December corn prices were also turbulent after 2020. In the five years before 2020, December corn traded in a stable range between roughly $3.15 and $4.50 a bushel. After hitting a low of $3 in April 2020, prices soared to a peak of $7.75 a bushel in 2021 and a second peak of $8.27 in 2022. Compared to those two years, Thursday's December corn price of $4.60 isn't looking so hot.

One of the problems of going through a volatile time like the past four years is that it's easy to lose our bearings. With USDA estimating U.S. corn ending stocks at 2.122 billion bushels (bb) in 2023-24 and looking ahead to the possibility of a larger surplus in 2024-25, today's supply situation compares well to the five years of similar U.S. corn surpluses before 2020's upheaval. The purchasing power of the dollar is lower, or we could say input costs are higher and interest rates are also higher.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

To get a more grounded sense of today's prices, I find it helpful to compare to USDA's estimates of production costs. For example, from 2015 to 2020, USDA's estimated production cost for growing corn averaged $680 an acre. USDA's most recent cost estimate for 2024 is $870 an acre, a 28% increase from the years when ending supplies were similar to today and December corn prices traded roughly between $3.15 and $4.50 a bushel.

If we divide Thursday's $4.60 price by 1.28, we get $3.59 a bushel, a price that used to be at the lower end of the old trading range. The other factor to notice is how commercials tended to turn net long in the market, when corn prices got near the low end of the trading range -- exactly what we would expect from the market segment that knows value best. I can't guarantee corn prices will go higher from here, but it is interesting to see commercials have been turning consistently net long since August 2023, and positions peaked in late February, when the price of December corn reached its pre-COVID equivalent of $3.48 1/2 a bushel.

A similar comparison for soybeans finds USDA estimating the cost of production at $615 an acre in 2024, up 30% from the previous period of 2015 to 2020. Thursday's close of $11.49 1/4 in November soybeans is the equivalent of $8.84 a bushel before COVID, a cheap price that was most often reached during the tariff dispute with China. USDA's latest estimate of U.S. ending soybean stocks in 2023-24 is 340 million bushels (mb), or 8.3% of annual use. That is not the kind of heavy supply scenario we would normally expect for a price that cheap.

The cost comparisons described above are best used to give us a rough idea of where prices might trade in 2024. But as you should know, there are no guarantees the same fundamental valuations will hold true in 2024. As we speak, it is looking like South American corn production will be modestly lower in 2024, but soybean production will be higher, somewhere near 7.3 bb or more.

I can't guarantee future prices but given the volatility corn and soybean prices have seen the past four years, I would say there is a chance current new-crop prices of corn and soybeans are nearing long-term support. Thursday's new one-month lows in corn and soybean prices don't make me confident about being bullish yet. But solid closes above the highs of March, if they happened, would certainly make prospects for 2024 prices much more interesting.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow him on social platform X @ToddHultman1.

(c) Copyright 2024 DTN, LLC. All rights reserved.