Technically Speaking Blog

Weekly Analysis: Livestock Markets

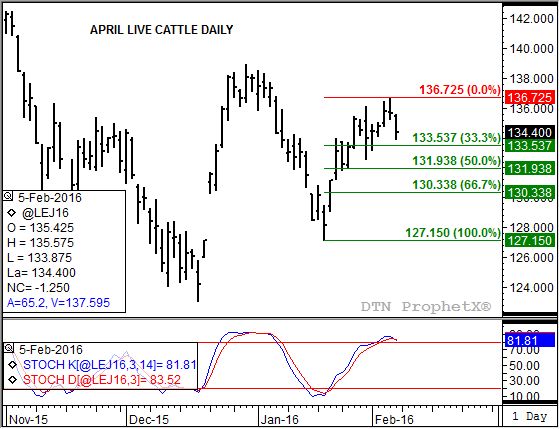

Live Cattle: The April contract closed $0.40 higher at $134.40. The secondary (intermediate-term) trend remains up with initial resistance pegged at the recent high of $138.95. Retracement resistance is at $139.025, the 50% level of the previous downtrend from $165.00 through the low of $123.05. The minor (short-term) looks to have turned down after last Friday's sell-off established a bearish crossover by daily stochastics. Minor support is between $133.525 and $131.95, the 33% and 50% retracement levels of the previous minor uptrend from $127.15 through last Thursday's high of $136.725.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feeder Cattle: March contract closed $3.425 lower at $15.825. March feeder cattle remain in a wide ranging secondary (intermediate-term) sideways trend between the recent high of $166.875 and the 4-week low of $147.775. Weekly stochastics turned neutral last week with a bearish crossover above the oversold level of 20%. This would indicate possible bearish momentum the next couple of weeks leading to a test of secondary support.

Lean hogs: The more active April contract closed $0.40 lower at $70.30 last week. Despite the lower close the secondary (intermediate-term) trend remains up, supported by continued noncommercial buying. Last Friday's weekly CFTC Commitments of Traders report showed this group adding 6,672 contracts, pushing their net-long position to 11,294*. Feb hogs are testing resistance between $69.55 and $71.05, prices that mark the 67% and 76.4% retracement levels of the previous downtrend, as weekly stochastics approach the overbought level of 80%.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.42 1/4, down 6 1/4 cents for the week. Despite the lower weekly close the secondary (intermediate-term) trend still looks to be up. However, the minor (short-term) trend has turned down with initial support near $3.41 1/2. This price marks the 33% retracement level of the previous minor uptrend from $3.27 1/4 through the high of $3.48 1/2. The 50% retracement level is down near $3.38. Daily stochastics are bearish.

Soybean meal: The March contract closed $7.40 lower at $265.00. The secondary (intermediate-term) trend remains sideways between the major (long-term) low of $263.80 and the 4-week high of $277.20. However, continued commercial selling had the contract near major support at last week's close threatening a move to a new low. If realized this could lead to an extended major sell-off to near $250.00 despite monthly stochastics indicating an already sharply oversold situation.

*The weekly Commitments of Traders report showed positions held as of Tuesday, February 2.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom