Technically Speaking Blog

Monthly Analysis: Livestock Markets

Live Cattle: The February contract closed at $132.35, down $9.375 on the monthly chart. The live cattle market continues to consolidate above technical support near $126.50, a price that marks the 50% retracement level of the previous uptrend from $80.225 (March 2009) through the high of $172.75 (November 2014). Monthly stochastics remain below the oversold level of 20%, still showing no sign of a potential bullish crossover. This could lead to another test of major support before the market's major (long-term) downtrend officially comes to an end.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

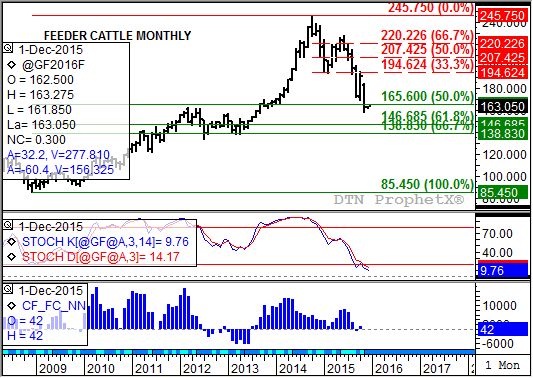

Feeder Cattle: The January contract closed at $162.75, down $28.15 on the monthly chart. The major (long-term) trend remains down with Jan feeders below technical support at $165.60. This price makes the 50% retracement level of the previous uptrend from $85.45 (December 2008) through the high of $245.75. Monthly stochastics (middle study) remain bearish below the oversold level of 20% indicating a possible test of next support between $146.70 and $138.80, the 61.8% and 67% retracement levels respectively.

Lean Hogs: The February contract closed at $56.80, down $2.40 on the monthly chart. The market extended its major (long-term) downtrend during November, hitting a new low of $51.80. However, the solid rally to close the month sets the stage for a possible bullish spike reversal. Weekly stochastics are nearing a potential bullish crossover below the oversold level of 20% that would indicate a move to an uptrend.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.46, down 9 cents for the month. Monthly stochastics show the major (long-term) trend is still up while NCI.X price activity since July shows a sideways trend is in place. Support remains between $3.44 and $3.23, prices that mark the 50% and 67% retracement levels of the rally from $2.81 (October 2014 low) through $4.06 (July 2015 high). Initial resistance is at the August 2015 high of $3.65.

Soybean meal: The January contract closed at $285.30, down $19.10 on the continuous monthly chart. The major (long-term) trend is down as the market moved to a new low of $278.50 during November. However, monthly stochastics are in single digits, indicating a sharply oversold situation, and could lead to consolidation above the November low.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom