Technically Speaking

Weekly Analysis: Grain Markets

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.49, down 6 cents for the week but 15 cents off its weekly high. The secondary (intermediate-term) trend remains sideways with initial support at $3.44 and resistance at $3.67. Weekly stochastics are neutral-to bullish above the oversold level of 20%.

Corn (Dec futures): The December contract closed 6.50cts lower at $3.82 3/4. Despite the lower close the secondary (intermediate-term) trend remains sideways-to-up. The contract did post a new 4-week high of $3.99 3/4 but was unable to maintain upward momentum through the end of the week. Support is now at the 4-week low of $3.75. Weekly stochastics remain bullish above the oversold level of 20%. Friday's CFTC Commitments of Traders report showed noncommercial traders adding 9,711 contracts to their net-long futures position.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

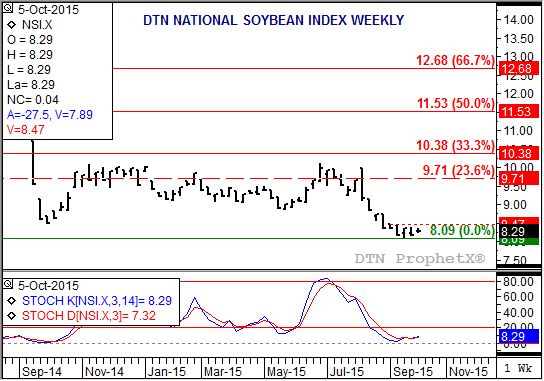

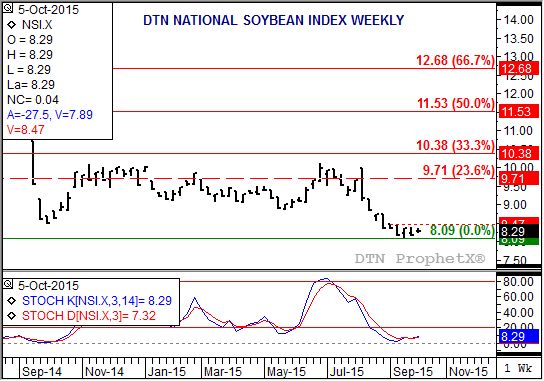

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $8.29, up 11 cents for the week. The secondary (intermediate-term) trend remains sideways with resistance at the 4-week high of $8.47 and support at the 4-week low of $8.09. Weekly stochastics remain neutral below the oversold level of 20%.

Soybeans (Futures): The November contract closed 11.50cts higher at $8.85 3/4. The secondary (intermediate-term) trend remains sideways-to-up. The most recent CFTC Commitments of Traders report showed noncommercial interests adding 3,771 contracts to their net-long futures position, providing support enough to offset increased commercial selling indicated by a stronger carry in the November to January futures spread. Initial resistance is at the 4-week high of $9.02 1/4 with support at the contract low of $8.53 1/4. Weekly stochastics remain neutral-to-bullish below the oversold level of 20%.

SRW Wheat (Cash): The DTN SRW Wheat National Index (SR.X, national average cash price) closed at $4.54, down 5 cents for the week. Despite the lower close the secondary (intermediate-term) trend remains up. The SR.X tested resistance between $4.61 and $4.81, prices that mark the 23.6% and 33% retracement levels of the previous downtrend from $6.23 to $4.11 before turning lower. Weekly stochastics are bullish, building on a crossover below the oversold level of 20% the week of September 8.

HRW Wheat (Cash): The DTN HRW Wheat National Index (HW.X, national average cash price) closed at $4.44, down 1 cent for the week. The secondary (intermediate-term) trend remains up with an initial target of $4.62. This price marks the 23.6% retracement level of the previous sell-off from $6.41 through the recent low of $4.06. The 33% retracement level is up at $4.85. Last week's high was $4.60 before moving lower. Weekly stochastics are bullish above the oversold level of 20%.

HRS Wheat (Cash): The DTN HRS Wheat National Index (SW.X, national average cash price) closed at $4.90, up 6 cents for the week. The secondary (intermediate-term) trend remains up with weekly stochastics bullish. Last week's high of $5.01 was a test of initial resistance at $4.97, the 23.6% retracement level of the previous downtrend from $6.68 through the recent low of $4.44. The 33% retracement level is up at $5.19.

The weekly Commitments of Traders report showed positions held as of Tuesday, October 6.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .