Technically Speaking

Weekly Analysis: Livestock Markets

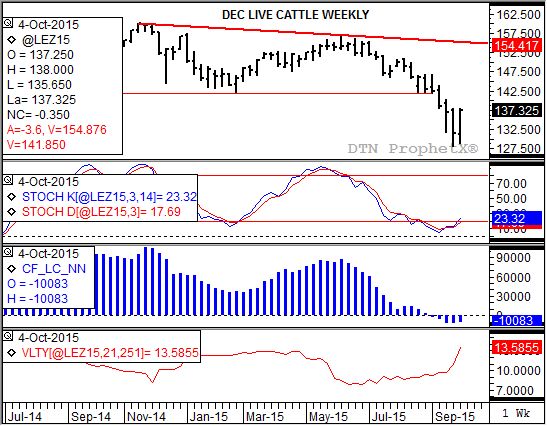

Live Cattle: The December contract closed $5.95 higher at $137.325. Weekly stochastics remain bullish indicating the contract could continue to build on strong buying seen much of last week. As has been discussed in this space numerous times, Dec live cattle recently tested major (long-term) support near $126.50 with its recent low of $128.10. This led to the sharp rally to test initial major resistance near $138.575 (last week's high was $138.00). Dec live cattle could continue to see strength as noncommercial traders cover a portion of their net-short futures position.

Feeder Cattle: The November contract closed $10.35 higher at $184.875 last week. The secondary (intermediate-term) trend looks to be up while the major (long-term) trend remains down with support pegged at $165.60. While monthly stochastics are above the oversold level of 20%, leaving the door open to renewed pressure, noncommercial traders could continue to cover their net-short futures position over the coming weeks.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean hogs: The December contract closed $0.75 higher at $66.125 last week. The secondary (intermediate-term) trend is up as noncommercial traders continue to add to their net-long future position. Friday's CFTC Commitments of Traders report showed this group adding 3,469 contracts, putting the position at 20,094. Initial resistance is at the 4-week high of $67.60, with major resistance pegged near $75.65.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.49, down 6 cents for the week but 15 cents off its weekly high. The secondary (intermediate-term) trend remains sideways with initial support at $3.44 and resistance at $3.67. Weekly stochastics are neutral-to bullish above the oversold level of 20%.

Soybean meal: The December contract closed $6.60 higher at $307.80. The secondary (intermediate-term) trend remains sideways with the contract consolidating near technical support at $302.90. This price marks the 76.4% retracement level of the previous rally from $286.00 through the high of $357.70. Weekly stochastics remain neutral-to-bearish, but below the oversold level of 20%.

The weekly Commitments of Traders report showed positions held as of Tuesday, October 6.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .