Technically Speaking

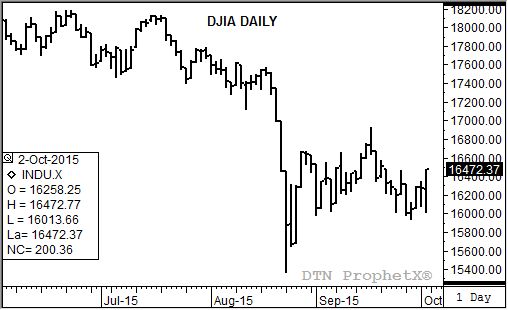

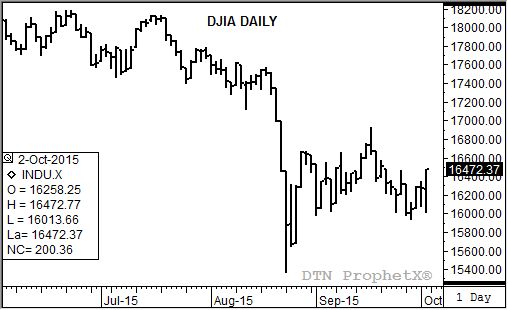

DJIA: Report Day Reversal

If any of you out there thought grain were the only sector to go bonkers on report day, let me introduce you to the financial markets. Early Friday saw the release of September nonfarm payroll data and unemployment rate, with pre-report estimates (according to WSJ's MarketWatch) coming in at 200,000 and 5.1% respectively. Upon release at 7:30 (CT), financial market analysts quickly started digesting the 142,000 and 5.1% figures. While no one was overly concerned about the unemployment rate, debate was how low the surprisingly bearish nonfarm payroll would drag the Dow Jones Industrial Average (DJIA).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Sure enough, the Dow didn't disappoint. Shortly after the open the DJIA found itself down almost 260 points, posting a low of 16,013.66. However, unlike October catastrophes of the past, the DJIA stabilized and by afternoon was starting to gain bullish momentum. By the time the closing bell rang the DJIA had posted a stunning rally of 200.36 points, nearly 460 points off its low.

A look at the daily chart shows the DJIA established a bullish reversal, trading well outside Thursday's range before finishing near its daily high. The question is what this might mean long-term. Those of you who have been following along with this blog know I've been bearish the DJIA for quite some time, its major (long-term) trend turning down somewhere between March and June of this year. Using Dow Theory retracements put the first target at 14,394.85. This level marks the 33% retracement of the previous major uptrend from 6,469.95 (March 2009) through the high of 18,351.36 (May 2015).

While Friday's rally was impressive on daily charts, it does nothing to change the long-term outlook. Monthly stochastics (long-term momentum) remains bearish and well above the oversold level of 20%. This would seem to confirm that the DJIA has more room to the downside after closing Friday at 16,472.37. And as stated earlier, October is truly the month for ghosts and goblins when it comes to the Dow (e.g. October 24, 1929, October 19, 1987, etc.).

It wouldn’t be surprising to see the DJIA consolidate for a week or two, but sooner or later it should test the possible bearish trigger point at the August low of 15,370.33. Once that's cleared, things could get interesting quickly.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .