Technically Speaking

Weekly Analysis: Livestock Markets

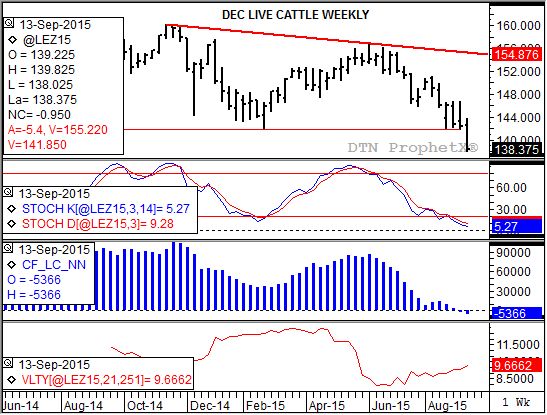

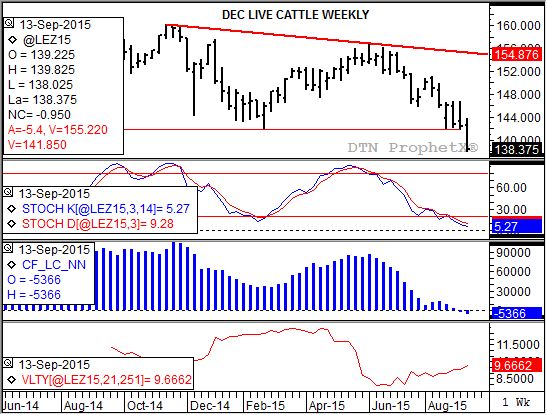

Live Cattle: The December (most active) contract closed $4.00 lower at $138.375. Dec live cattle posted a new contract low of $138.025 last week (thin red line), extending the secondary (intermediate-term) downtrend. This has Dec live cattle testing major (long-term) support between $141.95 and $137.40, prices that mark the 33% and 38.2% retracement levels of the previous major uptrend from $80.225 (March 2009 low) through $172.75 (November 2014 high). Given both weekly and monthly stochastics are below the oversold level of 20% the market could soon find renewed buying interest. Friday's weekly CFTC Commitments of Traders report showed noncommercial interests increasing their net-short futures position to 5,366, also a bullish factor as it could lead to short-covering support.

Feeder Cattle: The October contract closed $9.275 lower at $185.825 last week. The secondary (intermediate-term) trend remains down with October feeders posting a new contract low of $184.625. This has the contract testing major (long-term) support between $192.40 and $184.50, prices that mark the 33% and 38.2% retracement levels of the previous major (long-term) uptrend from $85.45 (December 2008 low) through $245.75 (October 2014 high). While weekly stochastics show the market is sharply oversold, monthly stochastics remain above the oversold level of 20% indicating the market, possibly the November of January contracts, could test the 50% retracement level of $165.60.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean hogs: The December (most active) contract closed $1.50 higher at $64.15 last week, posting a bullish outside range in the process. This indicates the secondary (intermediate-term) uptrend could continue to strengthen and gives further confirmation that Wave 2 of a major 5-Wave uptrend (Elliott) has come to an end. Friday's weekly CFTC Commitments of Traders report showed noncommercial interests increasing their net-long futures position by 3,143 contracts.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.43, down 14 cents for the week. Technical indicators continue to show the secondary (intermediate-term) trend to be sideways-to-up with the NCI.X last week's high of $3.63 a test of resistance at $3.67. This price marks the 50% retraceme4tn level of the sell-off from $4.06 through the low of $3.28. Support is pegged between $3.44 and $3.23, prices that mark the 50% and 67% retracement level of the initial leg of the major (long-term) uptrend from $2.81 (October 2014 low) through $4.06 (July 2015 high).

Soybean meal: The more active December contract closed $1.50 lower at $307.80. The secondary (intermediate-term) trend remains sideways after Dec meal fell back from its test of resistance at the 4-week high of $320.50 (last week's high was $318.90). With weekly stochastics still neutral-to-bearish the contract could now look at testing support at the 4-week low of $302.50. This would also be a retest of retracement support at $302.90, the 76.4% level of the previous rally from $286.00 through the high of $357.70. Friday's CFTC Commitments of Traders report showed noncommercial traders increasing their net-long futures position by 7,642 contracts. However, this buying interest continues to be offset by commercial selling indicated by the downtrend in futures spreads.

The weekly Commitments of Traders report showed positions held as of Tuesday, September 15.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .