Technically Speaking

Cash Propane: A Wet Harvest Ahead?

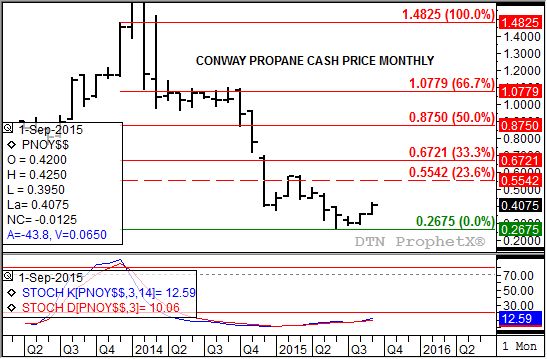

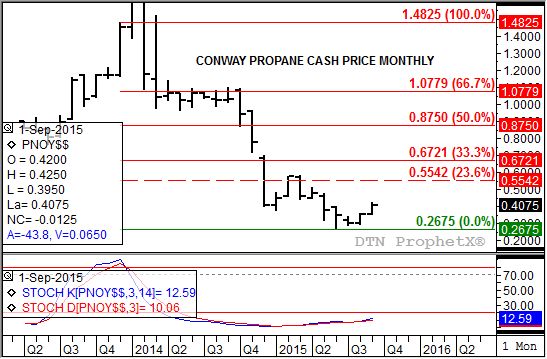

The Conway Springs cash propane market has slowly been building a major (long-term) uptrend, posting what looks to be a bullish breakout at the end of August. A look at the monthly chart shows cash propane closed July at $0.3038, near its monthly low of $0.2925. However, August saw the market rally to a high of $0.3625 before closing the month at $0.3550. The activity over July and August established a bullish 2-month reversal, indicating the major trend had finally turned from down to up.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Note that monthly stochastics (bottom study) has been bullish dating back to the end of February when it established a bullish crossover well below the oversold level of 20%. While the cash market took another six months to confirm this change in trend, eventually it did at the end of August.

As September gets under way, cash propane continues to move higher, finishing the first week at $0.4076, just off its high of $0.4250. The ongoing major uptrend could eventually see cash propane test resistance between $0.5542 and $0.6721, prices that mark the 23.6% and 33% retracement levels of the previous major downtrend from $1.4825 (December 2013 high) through the low of $0.2675 (June 2015).

A couple of interesting points about the recent trends in cash propane: First I tossed out the spike in January 2014 to $4.9525 as an anomaly. Call it editorial, or technical analyst's license. Second, note that 2013 also saw a fall rally in prices leading to the spike rally over the course of the winter.

Time will tell if the newly established major uptrend in cash propane is a nothing more than a seasonal move or if it portends a wet, drawn out fall harvest.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .