Technically Speaking

Weekly Analysis: Livestock Markets

Live Cattle: The October contract closed $1.80 higher at $145.925. Despite the higher close the secondary (intermediate-term) trend remains down with weekly stochastics bearish. Initial support is at the new 4-week low, last week's low, of $143.30. Major (long-term) support is between $141.95 and $137.40.

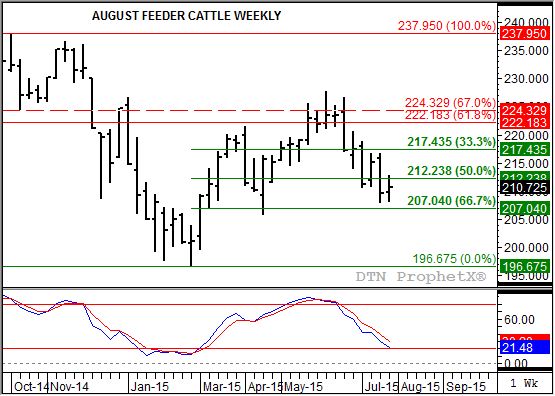

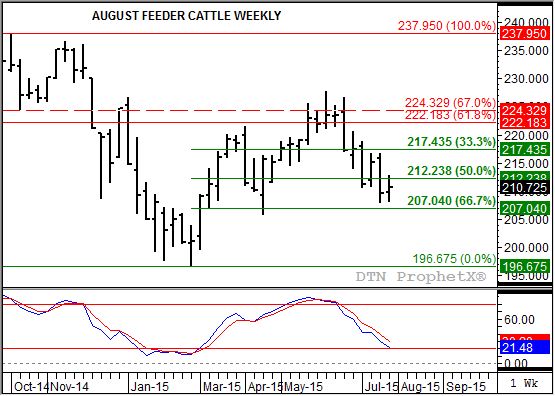

Feeder Cattle: The August contract closed $1.05 higher at $210.725 last week. The secondary (intermediate-term) trend remains down with next support near $207.05, a price that marks the 67% retracement level of the previous uptrend from $196.675 through the high of $227.80. Weekly stochastics are bearish indicating pressure should continue to be seen. The major (long-term) trend is down with support pegged near $192.35.

Lean hogs: The October contract closed $0.30 lower at $63.725 last week. Weekly charts continue to show no clear signals regarding the secondary (intermediate-term) trend. However, the October contract posted a new 4-week high of $67.425 before selling off. This could establish a secondary uptrend.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.43, down 18 cents for the week. Cash corn has collapsed after the NCI.X established a bearish reversal the week of July 13. This came on the heels of testing resistance at $4.08 with a calculated high of $4.06. Longer-term support remains at $3.31 with the previous low down at $3.29.

Soybean meal: The more active December contract closed $9.50 lower at $323.90. Despite another lower weekly close the secondary (intermediate-term) trend remains up. However, Dec meal did leave a bearish gap on its weekly chart between last week's high of $331.10 and the previous week's low of $332.10. The market's inverted forward curve continues to reflect a bullish commercial outlook, possibly limiting the sell-off to a test of support at $321.90, the 50% retracement level of the previous rally from $286.00 through the high of $357.70.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .