Technically Speaking

Sunday's Referendum Vote: It's All Greek to Me

Let me begin by saying, and most of you know this already, I am not an economist. Nor will I pretend to be. For true analysis of global economics on DTN, I always point people in the direction of Editor Emeritus Urban Lehner's blog, "An Urban's Rural View". But, that having been said, I do find the ongoing (some would say never-ending) drama regarding Greece's economic downfall interesting base on how it looks on price charts.

Recall that the basic tenet of technical analysis is that price action discounts everything. In other words, anything that can affect a market is reflected in its trade, with prices moves over time showing the overall impact. Do we know what the piece of news is that moves the market, any market? Not at the time, usually (There are exceptions: The wheat market and Chernobyl, live cattle and the first case of U.S. based BSE, etc.). Headlines appear later confirming what we already knew about market opinion based on technical analysis.

What, then, are the charts saying about the situation in Greece? To gain an understanding of market opinion, let's break it down by timeframes:

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Long-term: You know from my previous blogs (the latest being June 30) that I see the major trend of the U.S. dollar index (USDX) to be down. This dates back to a bearish 2-month reversal established at the end of April and is in contrast to roughly 99% of all other analysts and economists. Conversely, the major trend on the monthly chart for the spot-euro is up based on a 2-month bullish reversal at the same time that coincided with a crossover by monthly stochastics below the oversold level of 20%. However, both the euro and the USDX have been consolidating of late, hinting at a possible slide back to the lows (euro) before finding renewed buying interest. The initial long-term target is 1.2317, the 33% retracement level of the previous downtrend from 1.6008 through the March 2015 low of 1.0475.

Intermediate-term: The secondary trend on the weekly chart for the euro is sideways at this time, though still showing a bullish wedge pattern (higher lows, flat highs). The last secondary (intermediate-term) signal by weekly stochastics was a bullish crossover below the oversold level of 20% the week of March 16. Weekly stochastics have turned neutral below the oversold level of 80%, indicating one more push higher after possibly testing trendline support (calculated at 1.1030 this week). Initial upside resistance is pegged near 1.1428, with the target still of 1.1634. The latter marks the 33% retracement level of the previous secondary downtrend from 1.3955 through the low of 1.0475. The 50% retracement level is up at 1.2215. Note the proximity this is with the long-term target of 1.2317.

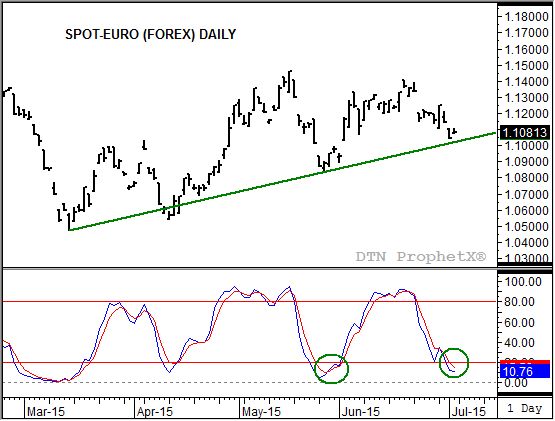

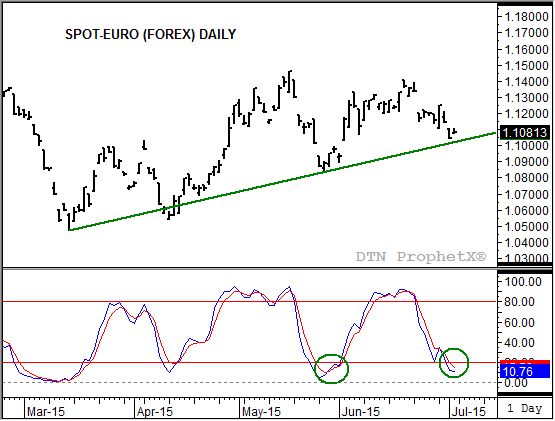

Short-term: Its daily chart (attached) shows the euro to be nearing a bullish crossover by stochastics (bottom study) below the 20% level. If/when this occurs it would signal a move to minor uptrend similar to what was seen beginning on May 28. Again, trendline support (connecting the higher lows) is pegged at 1.1024 Monday, July 6.

So what is this telling us about possible Greek vote results? Unfortunately, not much. As I pointed out in a recent On the Market column (June 19, "Greek Drama"), Greece falling out of the euro-zone could eventually be seen as bullish (similar to cutting off a gangrenous limb) for the euro. If that's the case, and the long-term trend is up, it would imply a no-vote on additional bailout conditions Sunday July 5.

Keep in mind though that, as I said before, the rest of the world may view this differently. The argument is that the destabilization that could occur by Greece falling out of the euro-zone might lead to another sell-off in the euro, causing it to move counter to its long-term signals.

I'm a technician at heart, meaning I'll let the market figure it out. For now my view remains the same, the constants of bullish technical signals indicate the euro should eventually extend its secondary and major uptrends while the minor trend also turns up. The "why", in regards to Greece, remains an unknown.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .