Technically Speaking

Livestock Markets: Weekly Analysis

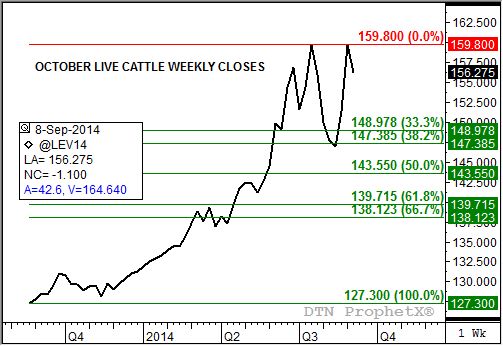

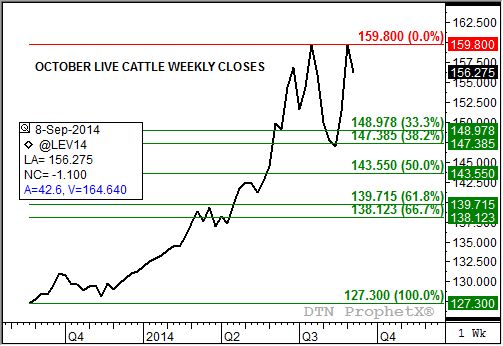

Live Cattle: The October contract closed $3.475 lower last week. The October contract looks to have established a top on a variety of weekly charts. This last week saw the contract establish a new high of $161.75, the fifth point of a 5-point topping pattern, before falling to its lower close. On the weekly close only chart (see attached chart) the contract looks to have established a classic double-top formation. Confirmation of either will take a sizeable sell-off, needing a move below the point 4 low of $144.25 and/or a weekly close below the interim low weekly close of $156.275.

Feeder Cattle: The October contract closed $1.55 higher last week. October feeders posted a new high of $229.825, continuing to indicate a possible 5-point top (for more information, see the Technically Speaking blog from Thursday, September 4). Trade volume increased last week to 24,132 contracts, an important characteristic of a 5-point top as opposed to declining volume of a head-and-shoulders formation. Weekly stochastics remain bearish, dating back to the crossover above the overbought level of 80% in conjunction with the first high (point 1) of the 5-point top the week of July 7.

Lean hogs: The October contract closed $0.075 higher last week. The secondary (intermediate-term) trend is up following the bullish crossover by weekly stochastics the week of August 18, 2014. However, the contract is testing resistance between $104.40 and $109.05, prices that mark the 50% and 67% retracement levels of the previous downtrend from $118.35 through the low of $90.45. Given the bullish commercial outlook indicated by the October to December futures spread, the contract could soon see a solid test of the previously mentioned 67% retracement level.

Corn: The DTN National Corn Index (NCI.X, national average cash price) closed at $3.12 3/4, down 17 1/4 cents for the week. The secondary (intermediate-term) trend remains down, in line with the market's seasonal index through the first week of October. National average basis (NCI.X minus the futures market) was calculated at about 26 cents under the December contract, fractionally weaker for the week. Weekly price distribution studies (close only) show the market to be underpriced. Last week's close puts the NCI.X in the lower 2% of the 5-year range, the lower 26% of the 10-year, the lower 18% since the beginning of corn's demand market with the 2005-2006 marketing year, and the lower 33% of the range since total domestic demand climbed above 10 bb during the 2003-2004 marketing year.

Soybean meal: The October contract closed $18.80 lower for the week. The secondary (intermediate-term) trend has turned down again, despite a continued bullish commercial outlook indicated by the inverse in the market's forward curve (series of futures spreads). Seasonally the market tends to trend down through September, with major (long-term) support on the monthly chart (most active contract) all the way down at $275.40 (low the month of December 2011).

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .