Technically Speaking

Energy Markets: Weekly Analysis

Brent Crude Oil: The spot-month contract closed $0.90 higher. The secondary (intermediate-term) trend appears to have turned sideways. Support is at the recent low of $101.07 while weekly stochastics are nearing a bullish crossover below the oversold level of 20%. Commercial buying has been indicated recently by the weakening contango in the nearby futures spread with last Friday's close showing 58 cents, compared to the previous week's settlement of 75 cents.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Crude Oil: The spot-month contract closed $2.31 higher. The secondary (intermediate-term) trend looks to have turned up following a bullish crossover by weekly stochastics below the oversold level of 20%. If so the initial price target is $98.32, a price that marks the 38.2% retracement level of the previous downtrend from $107.73 through the recent low of $92.50. However, given the bullish read on market supply and demand indicated by the backwardation in the nearby futures spread, the spot-month contract could test the $100.12 to $101.91 area, the 50% and 61.8% retracement levels respectively.

Distillates: The spot-month contract closed 3.22cts higher. The secondary (intermediate-term) trend looks to have turned sideways once again. Support is at the recent low of $2.8017 with resistance at $2.9175. A bullish breakout could lead to a test of $3.0711, the high from the week of June 16. Weekly stochastics established another bullish crossover below the oversold level of 20%, indicating a potential rally to the high side of the sideways price range.

Gasoline: The spot-month contract closed 11.55cts lower. The expiration of the September Friday led to a skewed weekly chart. While the market now shows a bullish outside week last week, recent activity had shown the spot-month contract to have established a secondary (intermediate-term uptrend. The market may take a week to sort its trends back out.

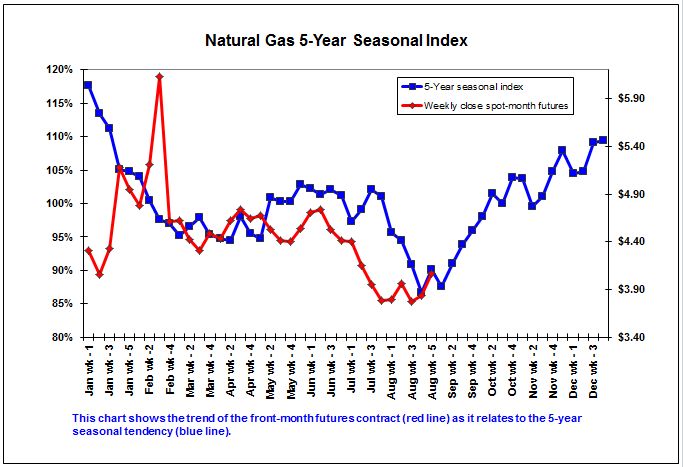

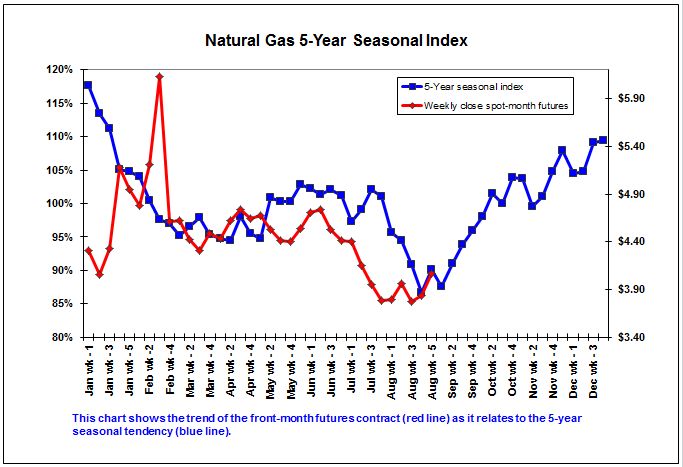

Natural Gas: The spot-month contract closed 22.5cts higher. The secondary (intermediate-term) trend is up following a bullish breakout by the spot-month contract last week. The spot-month moved above the 4-week high of $4.02, establishing a new high of $4.101 in conjunction with a bullish crossover below the oversold level of 20% by weekly stochastics. Seasonally the market tends to rally through the end of the year. The longer-term target is $4.781, a price that marks the 38.2% retracement level of the downtrend from $6.493 through the recent low of $3.723.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .