Technically Speaking

The Rocket Red Meat's Glare

It's the 4th of July holiday. Time to fire up the grill for whatever red meat you have on hand. And given the move in cattle prices this year, believe me when I say nobody will likely ask you for a specific declaration of what type of red meat it is.

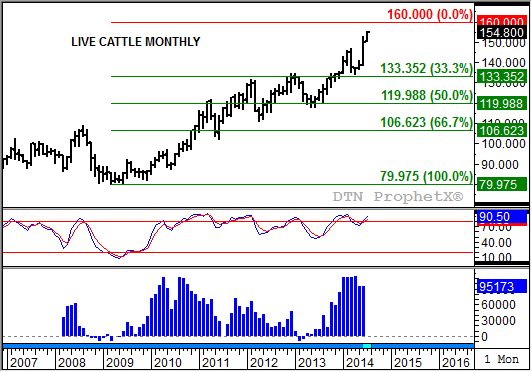

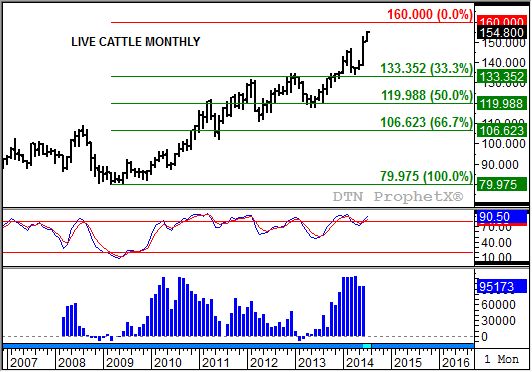

The live cattle monthly chart shows one of the more impressive uptrends I've seen in quite some time. True, it looks little different from what has been seen in other runaway markets in the past, but initial looks can be deceiving. Further analysis of the structure of live cattle shows just how strong the market is.

When I talk about market structure I'm referring to the combination of the two sides of any market, commercial and noncommercial.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In the case of live cattle, commercial traders remain bullish DESPITE this run to new all-time highs. This grabs your attention because in most runaway markets, commercial interest starts to wane as the futures market rockets higher. But the weekly close chart for the August to October futures spread (not shown, but available in DTN's Livestock Pro with the live cattle strategy) shows the August at a discount of roughly $2.40 to the October has it near the strongest level this spread has been over the last five years at this time. Again, that factor is made even more impressive by just how high the August is currently priced.

Normally in this type of near vertical uptrend, the market is driven higher by frothing-at-the-mouth noncommercial buying. However, this time around weekly CFTC Commitments of Traders reports shows that not to be the case. Weekly CFTC data for the non-commercial net-futures position plotted on a monthly scale (bottom study, blue histogram) shows that this group has reduced its net-long futures holding in late April of 114,376 contracts to 95,173 contracts in late June.

This combination of noncommercial traders growing less bullish while commercial traders remain bullish is unusual, resulting in a seldom seen Type 4 makret on DTN's 9 Market Type table. Handling a Type 4 market, as opposed to a Type 1 (both sides bullish), differs only in the possible use of long put options against the long cash position.

Using retracement analysis it looks like the nearby contract could extend this rally to a test of $160. If it is the August that accomplishes this, it would imply an additional rally of about $5. If it is the October that tests $160 after the August goes off the board, it implies an extension of the ongoing move by only $3.

Where did the $160 come from? By using that as a high price projection for the uptrend that began with the low of $79.975 from March 2009 the 33%, 50%, and 67% retracement levels line up relatively well with price support and resistance levels created during the rally. Yes, this is basically reverse engineering to establish an upside price target for a market trading at never before seen levels.

Recently, the 100-year anniversary of the start of World War I was noted. This war to end all wars was sparked by the use of an innocuous pistol, not unlike countless others of the day. Similarly, this historic move in live cattle started with monthly activity in June 2009 that at face value That month saw the nearby contract post an outside range versus May 2009 before closing higher. A nice bullish reversal, though not a key bullish reversal since it had not moved below the previous low of $79.975 posted in March 2009. In conjunction with its bullish reversal, June 2009 also saw the establishment of a bullish crossover by monthly stochastics, confirming the move to a major (long-term) uptrend. Last but not least, noncommercial traders had moved to a small net-long futures position of 10,099 contracts after holding a net-short position for most of the previous eight months.

From there the noncommercial net-long position would blossom to the previously mentioned April 2014 high of 114,376 contracts.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .