Technically Speaking

Ag Markets: Weekly Analysis

Corn: The July contract closed 12.00cts lower. The secondary (intermediate-term) trend remains down. The contract is below support near $4.56 meaning it could next target its previous low of $4.21 3/4. Weekly stochastics have not yet reached the oversold level of 20% giving the contract room to move lower. As expected, Friday's CFTC report showed noncommercial traders liquidating another 33,137 contracts of their net-long futures position, mostly by adding 30,492 short positions.

New-crop Corn: The December contract closed 10.25cts lower. The secondary (intermediate-term) trend remains down. However, the contract has found some buying interest near its previous low of $4.35. Weekly stochastics have not yet reached the oversold level of 20%, indicating the contract could see another test of its low. Pressure is expected to come from both sides of the market as noncommercial traders continue to sell and commercial traders grow more bearish, the latter indicated by the strengthening carry in the December to March futures spread.

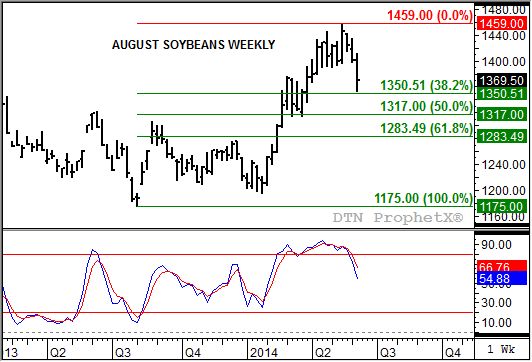

Soybeans: The August contract closed 31.50cts lower. The secondary (intermediate-term) trend remains down. The contract tested support near $13.50 1/2 last week, a price that marks the 38.2% (Fibonacci) retracement level of the previous uptrend from $11.75 through the recent high of $14.59. While futures spreads continue to suggest a bullish commercial outlook, weekly stochastics are bearish. This combination should lead to a 50% retracement back to support at $13.17. Friday's CFTC report showed noncommercial traders liquidated 21,207 contracts of their net-long futures position.

New-crop Soybeans: The November contract closed 2.50cts higher. The secondary (intermediate-term) trend is down. However, the contract is consolidating above support near $11.95 3/4, a price that marks the 33% Dow) retracement level. Support continues to come from the bullish commercial outlook indicated by the weak carry in the November to January futures spread. If the downtrend gains momentum, next support is at the 50% retracement level of $11.68 3/4.

Wheat: The July Kansas City contract closed 22.25cts lower. The secondary (intermediate-term) trend remains down. The contract established a bearish outside week, trading outside of the previous week's range before posting a lower weekly settlement. This would indicated that the contract should extend its downtrend to a test of support near $6.84 1/2, a price that marks the 67% (Dow) retracement level of the previous uptrend from $5.99 through the high of $8.55 1/2. Weekly stochastics are bearish and in agreement with the idea of a continued sell-off. Friday's CFTC report showed noncommercial traders moving to a net-short futures position in Chicago wheat.

Cotton: The July contract closed 2.20cts higher. The secondary (intermediate-term) trend remains down. However, the contract has stabilized between support at 87.25 and 84.07, prices that mark the 50% and 67% retracement levels of the previous uptrend. Weekly stochastics are nearing the oversold level of 20%, indicating that the contract could drift back toward the lower end of its support range. Friday's CFTC report showed noncommercial traders liquidating another 9,904 contracts of their net-long futures position.

New-crop Cotton: The December contract closed 0.25ct lower. The secondary (intermediate-term) trend remains down. Weekly stochastics remain bearish, indicating the contract could eventually test support at 75.25, its low from the week of November 25, 2013. Pressure continues to come from both sides of the market (noncommercial, commercial) with commercial selling indicated by the sharp downtrend in the December to March futures spread.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Live Cattle: The August contract closed $1.575 higher. The secondary (intermediate-term) trend is up. The contract (the cattle market in general) is in a runaway rally with no indication of where a top might be. Support continues to come from commercial as well as noncommercial traders. As for the latter, Friday's CFTC report showed this group adding 12,485 contracts to their net-long futures position, mostly by covering 12,167 contracts of short futures.

The most recent CFTC Commitments of Traders report was for positions held as of Tuesday, June 10.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .