Technically Speaking

Energy Markets: Weekly Analysis

Brent Crude Oil: The spot-month contract closed $4.80 higher. The secondary (intermediate-term) trend turned up. The spot-month contract moved through resistance at $112.56, the 67% retracement level of the previous downtrend from $117.34 to $102.98. This sets the stage for a possible extension of the rally to near the previous high. Weekly stochastics are neutral to bullish.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Crude Oil: The spot-month contract closed $4.25 higher. The secondary (intermediate-term) trend on the weekly chart turned up again. The spot-month contract blew through resistance $104.22 and $105.25, prices that mark the 61.8% and 67% retracement levels of the previous downtrend from $112.24 through the low of $91.24. Major resistance on the long-term monthly chart remains at $109.12. Weekly stochastics are neutral to bullish.

Distillates: The spot-month contract closed 11.64cts higher. The secondary (intermediate-term) trend is sideways to up. The spot-month contract spiked above resistance at the previous high of 3.0216 before closing the week back below that price level. Weekly stochastics remain neutral to bullish. Major (long-term) resistance on the monthly chart is pegged near $3.1485.

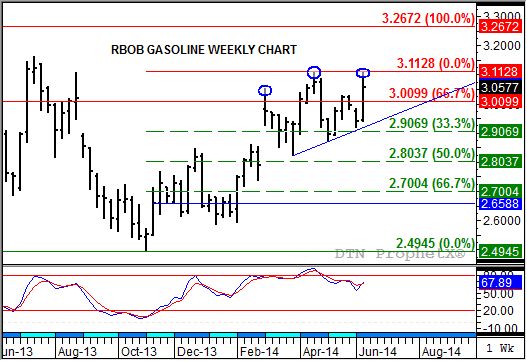

Gasoline: The spot-month contract closed 11.87cts higher. The secondary (intermediate-term) trend is sideways. Despite this past week's rally that saw the spot-month contract test resistance at $3.1128, the contract continues to indicate head-and-shoulders topping pattern is forming. Neckline support this week is calculated at $2.9277. Weekly stochastics remain neutral to bearish.

Natural Gas: The spot-month contract closed 2.9cts higher. The secondary (intermediate-term) trend remains sideways. The spot-month contract is moving toward a test of resistance at the recent high of $4.852. Support remains between $4.414 and $4.249, prices that mark the 61.8% and 67% retracement levels of the uptrend from $3.129 through the high of $6.493. Weekly stochastics are neutral to bullish.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .