Technically Speaking

Cotton: Seasonably Soft

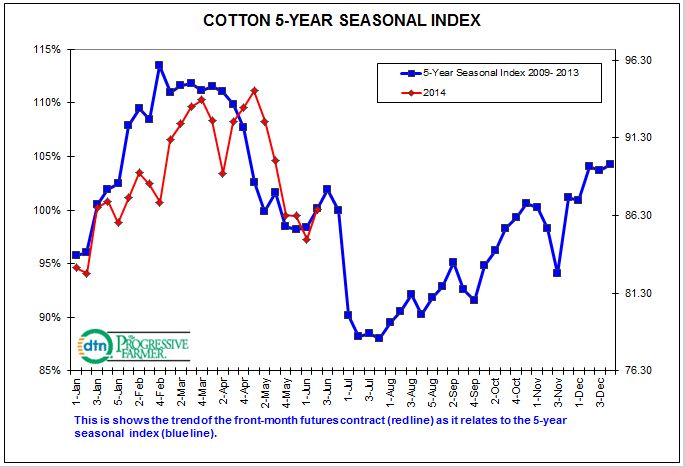

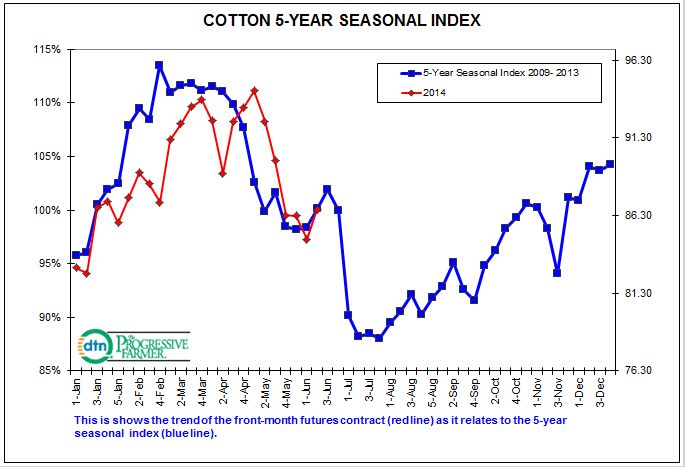

Comparing this year's cotton market (weekly closes for the nearby futures contract) to its five-year seasonal index shows a correlation of about 64%. This is a relatively strong relationship between the two, particularly given the divergence in the first quarter between the normal peak in late February versus this year's high weekly close in early May.

Since then though the two have been in step. So much so that the rally this week fits in nicely with the slight bump in the index, a move that carries into next week's close before the market starts heading down again.

Keeping in mind that seasonal indexes are best used as guides rather than hard and fast rules, we can try to solve the question of where the cotton market may ultimately be headed. From the secondary high weekly close the third week of June through the seasonal low the last week of July, the index shows a drop of 14%. The entirety of the seasonal downtrend from early February amounts to 25%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This year cotton futures posted a high weekly close of 94.32 cts. The sell-off to the low weekly close last week of 84.78 amounted to roughly 10%, less than the normal 15% initial decline. If the futures market continues to follow its seasonal index, next week's close should be between 87.06 and 88.17. From there the nearby futures market would be projected to fall to a low weekly close near 75.35 in late July.

How does this fit with the technical picture of the market? Two out of the last three weeks the July futures contract has posted a low near support at 84.07. This price marks the 67% retracement level of the previous uptrend from 77.74 through the high of 96.76. Meanwhile, weekly stochastics have moved near the oversold level of 20%. Given this combination the July contract could be hard pressed to move much below its technical price support.

So what about the possible move to near 75.00? Remember that the seasonal index takes into account the weekly close of the NEARBY futures contract. However, in the case of cotton I tend to skip the thinly traded October contract and go right to the new-crop December when the July goes off the board. This week, the July to December spread is at roughly 9 cents, and if this price relationship continues to hold another test of the 84.00 level by the July would result in a move to near 75.00 by the December.

It is also interesting to note that on its own five-year seasonal index, the new-crop December futures contract tends to rally 15% from late July through mid-November. The March contract then takes it the rest of the way back to its seasonal high the following February.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .