Technically Speaking

The Little Engine (KC Wheat) That Might

Recently the corn market has extended its downtrend, while soybeans have just indicated a southward move is likely, and Chicago wheat can find no friends. Add to that a strong seasonal bearish move in cotton, and it seems like the crop complex in general is ready to throw in the towel for the summer. But, a couple of minor (at least by trade volume) markets are trying to make a stand. Both Kanas City and Minneapolis wheat markets have stabilized, and if left to their own devices would likely post decent rallies.

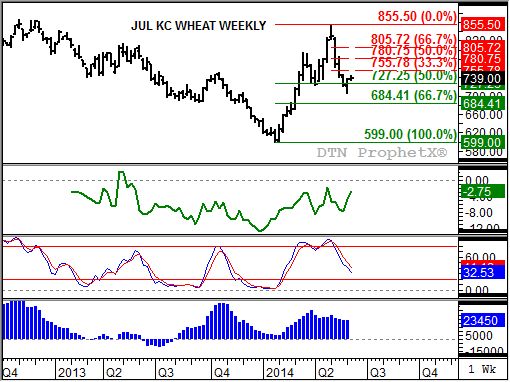

The weekly chart for the July Kansas City contract is interesting. Early last week, as the contract set a new low for this sell-off, it seemed that the HRW market was set to face the same bearish fate as the rest of the complex. But as they say, a funny thing happened on the way to the morgue. The July contract started to ignore spillover pressure from the other markets and rallied into the weekend.

Where did this resolve come from? A look at the history of CFTC Commitments of Traders numbers (bottom study, blue histogram) shows that noncommercial traders have in general been liquidating the net-long futures position since late March 2014. Back then the position was reported at 35,486 contracts. Last Friday's report (held contracts as of Tuesday, June 3) showed the noncommercial net-long at 23,450 contracts.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In conjunction with the selling by noncommercial traders, weekly stochastics (third studies) show momentum in a decline.

Why then has the contract been able to stabilize? Most notably, the short-term commercial outlook remains bullish. Notice that the July to September futures spread (second study, green line) is showing a carry of only 2 3/4 cents. This amounts to a low percentage of full commercial carry (exact figures difficult to calculate due to the variable storage rates associated with the wheat market) indicating the commercial side of the market remains concerned over supply and demand issues. But there is more than just a weak level of carry, the spread is actually trying to trend up, needing a weekly close above the previous peak of 1 3/4 cents to set the stage for a possible move into backwardation (inverted futures spread).

Also notice that last week's spike low to $7.06 took it well below calculated support at $7.27 1/4. This price marks the 67% retracement level (Dow Theory retracements still work best in Kansas City wheat) of the previous uptrend from $5.99 through the high of $8.55 1/2. Keeping in mind the wheat market's propensity for spike moves leading to false technical signals, the rally to close out the week isn't all that surprising. In fact, the July KC wheat contract was able to come all the way back to close above its previously mentioned technical support.

Where to from here? Much will depend on the action in the futures spread. If it grows more bullish the contract could test resistance between $7.80 3/4 and $8.05 3/4, the 50% and 67% retracement levels of the sell-off from the previous high ($8.55 1/2) through last week's low ($7.06). However, if commercial support starts to waiver due to harvest, the contract may only be able to muster a 33% ($7.55 3/4) to 50% retracement of the previous move.

To track my thoughts on the markets, follow me on Twitter: www.twitter.com\DarinNewsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .