Technically Speaking

July Cotton: Anything but Soft or Bearish Clouds Ahead?

It is hard to argue with the idea that the old-crop cotton market has been on a bullish run of late. A look at a weekly close only chart shows the contract has rallied from a low of 90.45 (week of April 7) to a high weekly close this past week of 94.32. Comparing to what is normally seen this time of year, the five-year seasonal index (not shown) shows the contract tends to trend down from late February through late July.

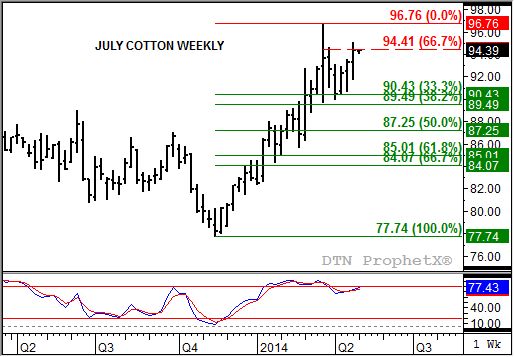

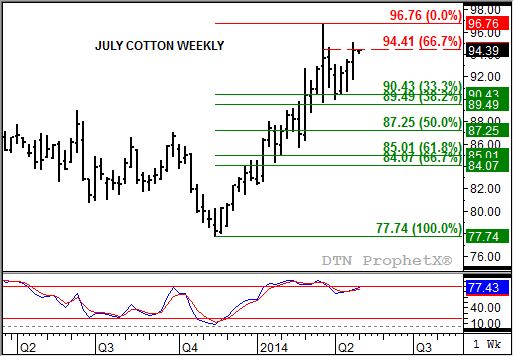

But before we get extremely bullish the cotton market, we also need to add a little more noise to the picture and look at the weekly price chart. Notice that the July contract continues to run into resistance, particularly with weekly closes, near 94.41. This price marks the 67% retracement level of the initial seasonal sell-off from the high of 96.76 (week of March 24, 2014) through the recent low of 90.02 (week of April 7).

There are a couple of interesting points regarding the initial sell-off. First, notice that weekly stochastics established a bearish crossover the week of February 24, 2014 with a confirming signal the week of March 24. This dual signal is usually a strong indicator that the trend has turned down. Next notice the price level where support was found. The initial sell-off resulted in a test of price support between the 33% retracement level (90.43) and 38.2% retracement level (89.49).

It will be important to see how the contract handles the 94.41 level this week. If resistance to hold, then it could be argued that the contract should next test support at the 50% retracement level of 87.25. However, if the market is able to build support from noncommercial traders (last Friday's CFTC Commitments of Traders report showed this group adding 3,401 contracts to their net-long futures position) and push through this resistance, then it is possible the July contract could make a run at its previous high.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .