Technically Speaking

July KC Wheat's Technical Picture

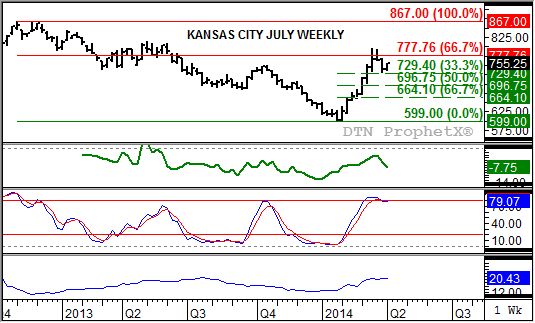

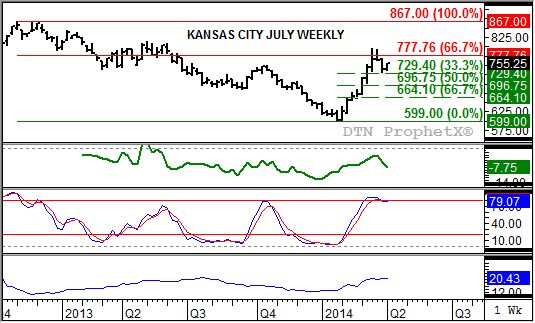

If you look at the DTN Winter Wheat Crop Condition Index chart posted in the Grains segment Wednesday one would almost immediately turn bullish July KC (HRW). However, the contract's weekly chart paints a somewhat different picture.

Weekly price action (top chart) shows the contract has fallen back from its recent high, to the point of testing initial support near $7.29 1/2. This price marks the 33%* retracement level of the previous uptrend from $5.99 through the high of $7.94 1/2. Notice that there were two weeks where the contract posted highs above resistance near $7.77 3/4, a price that marks the longer-term 67% retracement level of the previous downtrend from $8.67 through the $5.99 low, but the contract did not close above this resistance.

Also, weekly stochastics are near the overbought level of 80%, but have not established a bearish crossover above this level. This means that the contract could rally again, with another test of the $7.77 3/4 level expected. To push past this mark the contract will need to see increased support from both commercial and noncommercial traders.

In regards to the latter, this group has been building its net-long futures position of late, with last Friday's CFTC Commitments of Traders report (as of Tuesday, April 1) showing an increase of 3,394 contracts from the previous week to 35,486 contracts. However, market volatility (bottom study) has also been on the rise, sitting at almost 20.5%. Usually, noncommercial traders are reluctant to add substantially to positions at times of elevated market volatility, unless market fundamentals dictate otherwise.

In this case, that means the commercial outlook needs to grow more bullish. Again, based solely on crop conditions that would seem to be a no-brainer, but a look at the trend in the July to September futures spread (second study, green line) would suggest otherwise. Notice that recent weeks have seen the spread trend down, falling from a carry of only 3 cents (in conjunction with the high in July futures contract of $7.94 1/2) to this week's 7 3/4 cents. Based on a standard cost of carry table, questionable at best given the ongoing issue of variable storage rates, the 7 3/4 cents amounts to roughly 56% of full commercial carry, a neutral level. This would imply that the market has already priced in the worsening conditions, and is fully cognizant of the lack of correlation between initial condition numbers and final yield.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\Darin Newsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .