Technically Speaking

The Last Roundup for June Live Cattle?

Using charts for analyzing livestock markets has historically been about as fruitful as picking nothing but favorites in the NCAA basketball tournament. Meaning that while it looks good on paper, seldom did reality follow suit. Nevertheless, the bearish key reversal seen on the weekly chart for the more actively traded June live cattle contract seems to fit with the short-term bearish pattern of the front-month April contract discussed in the March 6 post ("Elliott Waving Goodbye to Apr Live Cattle").

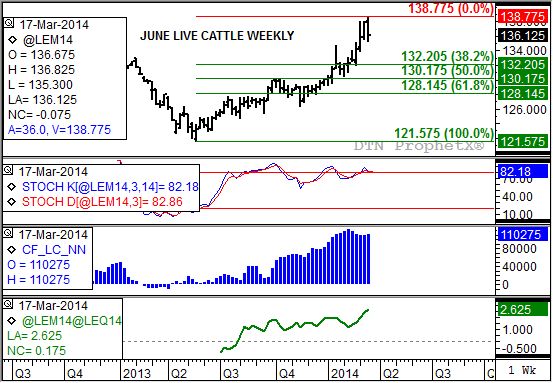

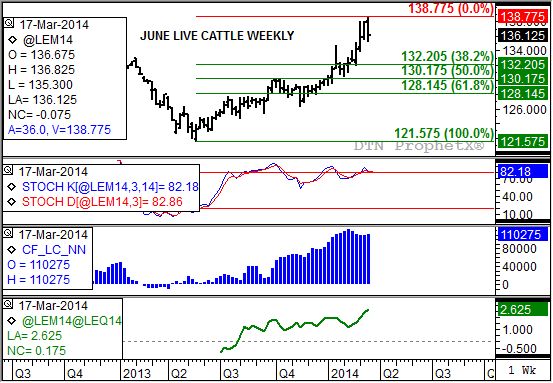

First, let's revisit the bearish key reversal I mentioned in this past Saturday's Weekly Ag Analysis blog. Last week saw the June live cattle contract post a new high of $138.775 before falling below the previous week's low of $135.55 and closing lower for the week. This is a classic key bearish reversal pattern, leaving no doubt that the secondary (intermediate-term) trend should now turn down.

And if that isn't enough, weekly stochastics (second study) established a bearish crossover confirming the change in trend seen on the weekly price chart. Friday's close saw the faster moving blue line finish at 82.2%, with the slower moving red line at 82.9%. The fact that both were above the overbought level of 80% is significant, for if not (e.g. the situation in soybeans) weekly stochastics would indicate a move to a sideways trend instead.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

If pressure is seen in live cattle, it is likely to come from noncommercial traders. The June priced in the $130's puts the contract in the upper percentages of the five-year distribution range at the same time the contract is showing signs of being overbought (weekly stochastics above 80%). Weekly CFTC Commitments of Traders numbers show noncommercial traders have trimmed their net-long holdings from a high of 123,025 contracts (week of February 10) to 110,275 contracts in last Friday's report (through Tuesday, March 18).

This group is expected to continue this long liquidation activity following Friday's bearishly perceived Cattle on Feed report. However, the June to August futures spread (bottom study, green line) shows the June contract continuing to gain on the August, reflecting an increasingly bullish commercial outlook.

Given the combination of possible noncommercial selling against continued support from a bullish commercial outlook, a possible sell-off in the June contract would not be expected to exceed $130.175, a price that marks the 50% retracement level of the previous uptrend from $121.575 through last week's high. Initial support at the 38.2% retracement level near $130.20 is expected to be breached, but such a move should spark increased commercial interest.

To track my thoughts on the markets, follow me on Twitter: www.twitter.com\DarinNewsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .