Technically Speaking

Developments in Corn

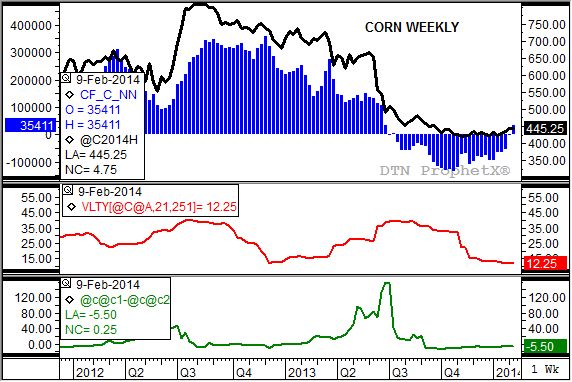

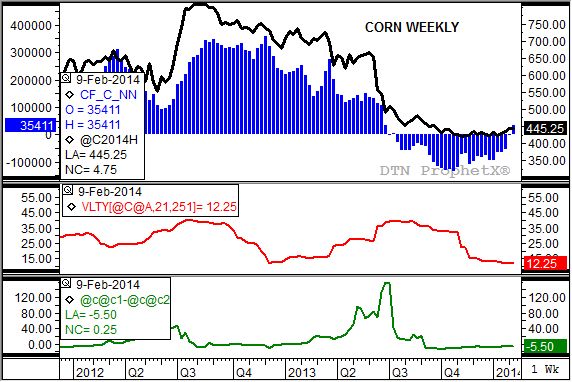

As discussed in a variety of places on DTN, the corn market has been quietly establishing an uptrend of late (black line, top chart). Those of you familiar with DTN's Six Factors recall that usually, uptrends are the result of increased noncommercial (speculative, investment, fund, etc.) buying interest. Therefore, when the weekly CFTC Commitments of Traders report was released Friday afternoon (positions as of Tuesday, February 11) it was not surprising that this group had moved from a net-short 1,293 contracts the previous week to a net-long 35,411 contracts (blue histogram, top chart).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A number of factors now look bullish for corn as we slowly, slowly, head toward spring. I've already mentioned noncommercial traders have covered their net-short futures position and could now start to build on their net-long position. Why would they do this? For starters, market fundamentals remain neutral to bullish.

Note that the nearby futures spread, in this case the March to May (bottom study, green line), is showing a weak carry of 5 1/2 cents. When measured on the scale of full commercial carry (total cost to hold grain in commercial storage), this 5 1/2 cents equates to roughly 44% of total cost of carry. The soon to be nearby May to July spread (4 1/4 cents carry), sits at about 34% of total cost of carry. Noncommercial traders like to buy into markets showing fundamental potential.

Also, market volatility is low (second study, red line). The 12.3% registered at Friday's close (weekly close only) is approaching the low volatility of 11.9% seen the week of December 10. Given the neutral to bullish commercial outlook, and the seasonal tendency of the cash corn market (DTN National Corn Index) to rally through mid-June (16% from its winter low), noncommercial interest could be primed.

The weekly chart for the March contract (closed Friday at $4.45 1/4) shows initial resistance at $4.65, with a longer-term target near $5.07 1/2. For the May, initial resistance is pegged near $4.72 3/4, then $5.01 3/4. If the DTN National Corn Index holds to its seasonal pattern, and based off its low weekly close near $4.02 (last week of November 2013), it could target $4.66 (weekly close). If national average basis holds steady near 21 cents under, nearby futures would be projected near $4.90.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .