Technically Speaking

Dec Corn Quietly Growing Bullish

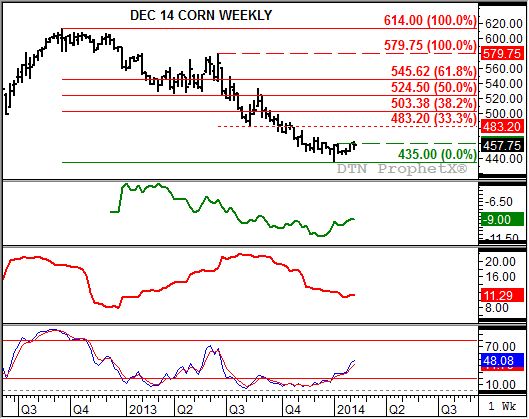

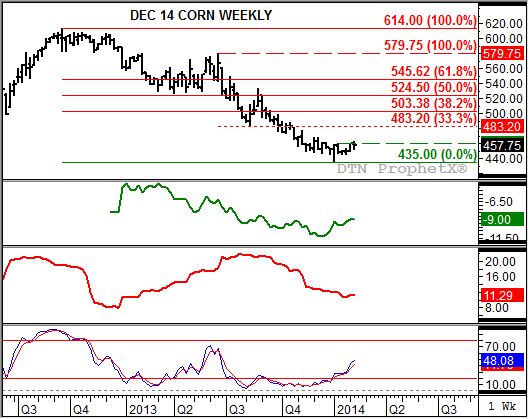

When you first look at it, the weekly chart for December 2014 corn looks similar to a dish of vanilla ice cream, with vanilla wafers, topped with marshmallows. In other words rather bland. But a closer inspection of the market could be enough to keep market bulls hopeful.

Notice that this week's activity has seen the contract pop through its previous high of $4.60 (week of January 13) and $4.60 3/4 (week of February 13), hitting $4.63 1/4 this past Monday. This move to a new four-week high coincides with continued bullish weekly stochastics (bottom study) indicating the secondary (intermediate-term) trend has turned up.

Support could continue to come from the commercial side of the market, as indicated by the weakening carry in the December 2014 to March 2015 futures spread (second study, green line). This carry has moved to 9 cents as it continues to trend up. Next resistance is pegged near the 7 3/4 cent carry mark, the 50% level of the range from the weakest the spread was at 4 cents (week of March 4, 2013) and the strongest the carry in the spread was at 11 1/4 cents (week of December 16, 2013).

Market volatility (third study, red line) also remains low, calculated at about 11.3%. Note that this has ticked up in recent weeks, and could continue to increase as the market gets closer to planting/growing season. This low level of volatility could entice noncommercial traders to buy into the market, possibly through call options that appreciate as the futures market rallies, and as volatility increases.

If the futures market is able to build bullish enthusiasm, initial resistance is pegged near $4.83 1/4, a price that marks the 33% retracement level of the sell-off from $5.79 3/4 (high the week of June 17, 2013) through the low of $4.35 (week of January 6, 2014). Longer-term resistance is near $5.03 1/2, the 38.2% retracement level of the previous secondary downtrend from the contract high of $6.14 (week of September 17, 2012). If weather and acreage create more excitement than expected at this time, a rally to the 50% level of $5.24 1/2 can't be ruled out.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\Darin Newsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .