Technically Speaking

Instant Oats

Whenever, talk of oats grows louder, I can't help but think of what the late Gary Wilhelmi used to have to say about the market. Gary for years was DTN's Man on the Floor, reporting on Board of Trade action until pit activity gave way to computers.

His take on oats always made me chuckle. If memory serves me, he would always start with the familiar "Oats Knows" saying that the market was not as heavily polluted by investment trade, meaning actual fundamentals played more of a role in market direction. That and the pit was run by one man, one of the meanest men Gary had ever known, and a couple of his pals. The old story was that they would wait, like piranha, for some green trader to wade into their stream like a fatted calf. At that point it wasn't that the newby would fell pain, but how much pain before he was able to get out.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

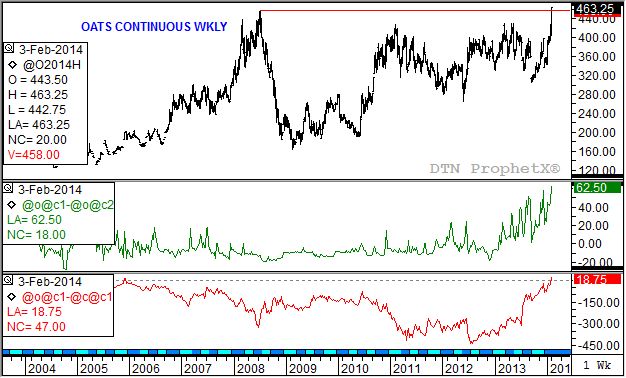

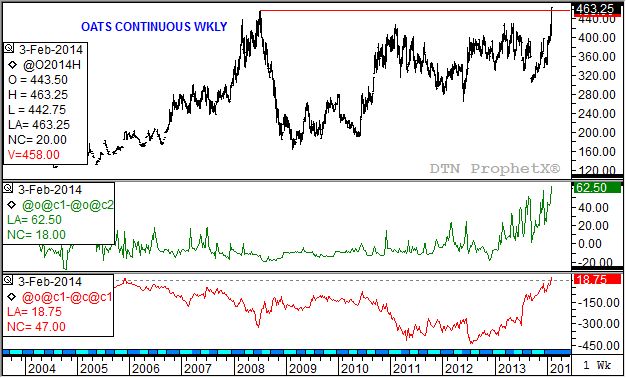

But today the oat market has moved front and center with its explosive recent rally. Back in mid-September 2013, the nearby contract was priced near $3.00, toward the low end of the sideways trading range dating back to early September 2010. Since then though, the market has rocketed beyond the historic high of $4.58 from (week of July 7, 2008), with Thursday's limit up (20-cent) move up posting a new pinnacle of $4.63 1/4.

While there has been some noncommercial buying interest, the most recent CFTC Commitments of Traders report showing this group holding a net-long of 2,744 contracts (week ending Tuesday, January 28), down 294 contracts from the previous week. It is a strong possibility that this Friday's report (positions as of Tuesday, February 4) shows this position increasing.

Stronger support has come from the commercial side of the market. Note that the nearby spread, now the March to May (green line, second study), is showing one of the strongest inverses on record, sitting at 62 1/2 cents Thursday. This reflects that supply and demand is way out of line, with demand far outdistancing available supplies. Often these short-supply spike rallies meet an equally swift end, but there are no signs of that happening at this time.

Also note that the nearby March oat contract is holding roughly a 19-cent premium over March corn (bottom study, red line). If it holds at this level through the weekly close Friday, it will outdistance the previous peak of 9 1/4 cents in early December 2005. Think about that for a moment. This will be the first time lowly oats have been higher priced than "King Corn" since early in the latter's demand market that began in early 2006.

As for the expanded "Oats knows where corn goes" theory: we'll see if corn reacts. Its own charts are slowly growing more bullish, with daily and weekly studies hinting at new uptrends. Futures spreads are also trending up, reflecting a weakening carry that could blossom into an inverted forward curve. If all this happens, then corn could indeed follow the path laid recently by oats.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .