Technically Speaking

Dow: Singing a Familiar Springsteen Tune

It's one of the Bosses' easiest choruses to memorize, "I'm going down, down, down, down. (Repeat frequently)." A look at any chart you choose of the Dow Jones Industrial average (daily, weekly, monthly) and you'll see a market that epitomizes these familiar lyrics.

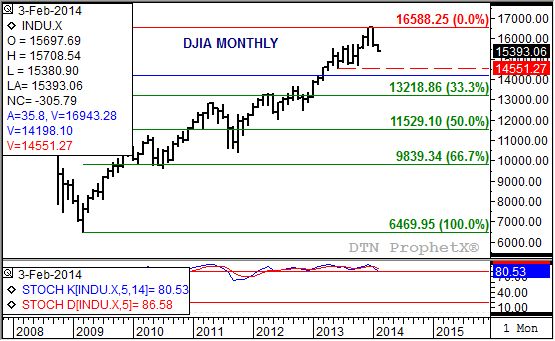

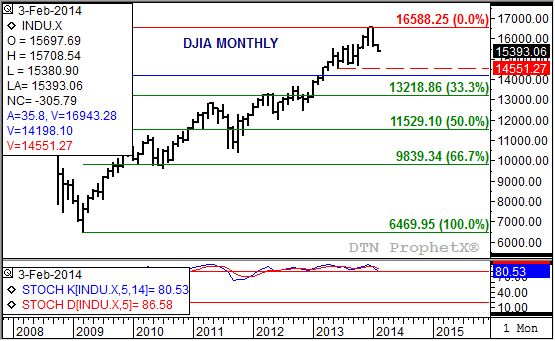

I chose the long-term monthly chart for this blog post, as it best shows how much potential risk there is in U.S. equities at this time. As February gets under way the DJIA seems content to extend its recently established downtrend, showing a loss of more than 300 points late in Monday's session.

The warning flag that a change was coming occurred in January as the Dow failed to take out the previous month's all-time high of 15,588.25. As the index sagged to close out the month, stochastics (bottom study) established a bullish crossover indicating the major (long-term) trend could turn down.

I know what you're thinking. I see it too. Monthly stochastics have established a number of similar signals going back to 2012, so why should this one be any different? The answer lies in the performance of the DJIA itself. In January, the Dow not only failed to take out its previous high, but did move below and close below the December low of 15,703.79. Given this bearish close it was not surprising when sellers hit the market again as February got rolling.

The flip side of the coin is that since the Dow did not establish a new high in January before falling, it did not establish a major bearish key reversal. While I might be splitting hairs here, the difference is the degree of a sell-off that could follow. As it stands, support is pegged at 13,218.86, the 33% retracement level of the previous uptrend from 6,469.95 through the December high. Before that, the Dow could find support near 14,550, a level that held a series of lows from June 2013 through October 2013.

Had the Dow established a major bearish key reversal, a 50% retracement back to 11,529.10 could be expected. A worst case scenario would have taken it down to support at the 67% retracement level of 9,639.34.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\Darin Newsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .