Technically Speaking

Crude Behavior

The hype and hubbub over Super Bowl XLVIII (48 to you and me) is gaining momentum, with much of the early prattle about Seattle Seahawks' cornerback Richard Sherman's post-NFC Championship game rant. Needless to say, I'll leave that thought provoking analysis to the countless talking heads on radio and television who will soon make some of us wish the Super Bowl was never invented.

When I talk of "Crude Behavior", it's in regards to recent developments in the crude oil market. Crude has posted a strong rally of late, capped by an explosive move Wednesday that has seen the spot-month contract gain almost $2.00. It is also interesting to note that this move shouldn't have caught participants by surprise.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

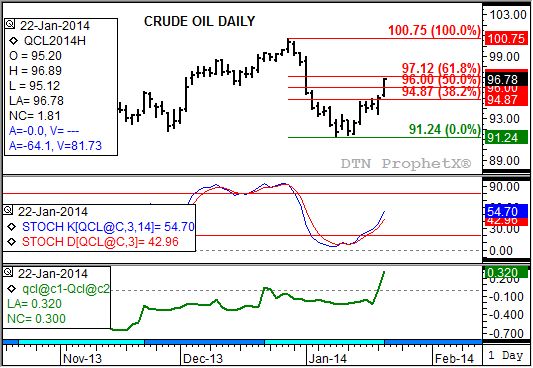

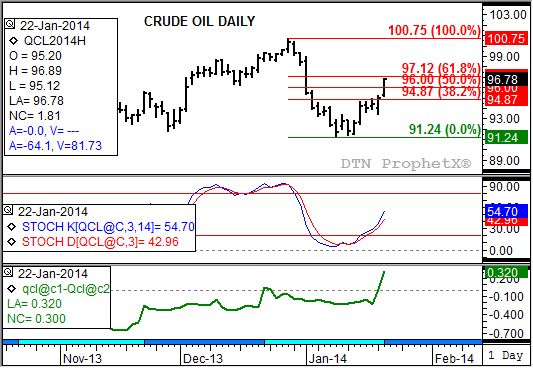

Here's why, from a technical point of view the market has been hinting at a turn to an uptrend since establishing its minor (short-term) low of $91.24 on January 9. Over the next few sessions the spot-month contract consolidated, posting lows of $91.99, $91.43, and $91.50 on January 14.

Also notice that it was on this day (January 14) that daily stochastics (middle study) established a bullish crossover, meaning the faster moving blue line crossed above the slower moving red line with both below the oversold level of 20% (11.1% and 9.7% respectively). The failure to make new lows in the futures market in conjunction with this bullish crossover hinted that the next move would be an uptrend.

How far would the uptrend possibly go? Using the previous downtrend from $100.75 (high from December 27, 2013) through the low of $91.24 gave us Fibonacci retracement targets of $94.87 (38.2%), $96.00 (50%), and $97.12 (61.8%). Given the recent bullishness of market fundamentals, indicated by the move to an uptrend and backwardation in the nearby futures spread (bottom study, green line) a 61.8% retracement if not a full test of the previous high seemed likely.

What has happened? The spot-month contract has raced to a high of $96.89 Wednesday, just short of the 61.8% retracement level. With daily stochastics still bullish there would seem to be ample momentum to carry the rally back to near $100 in the coming days.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .