Technically Speaking

The Rally in the Cash HR Wheat Protein Spread

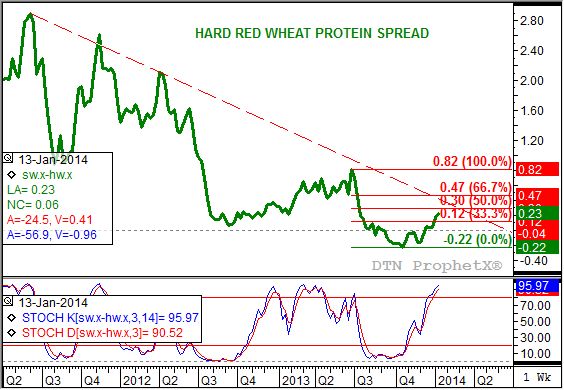

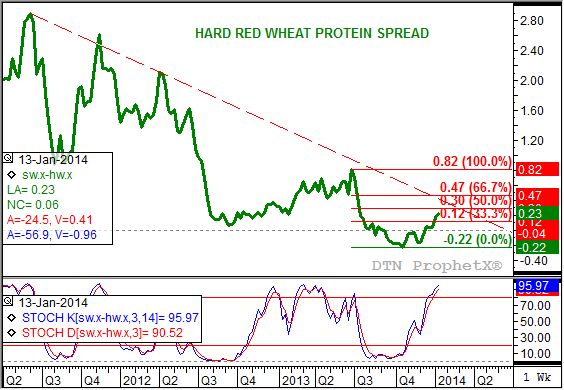

I was recently asked if I used the same tools to analyze trends in futures spreads as I did the futures markets. The answer is yes, as this chart showing the spread between the DTN National HRS Wheat Index (futures specifications call for 13.5% protein) and the DTN National HRW Wheat Index (futures specifications of 11.0% protein) shows.

There has been a great deal of talk of late over the explosive move in the spring wheat cash market as merchandisers look for high protein supplies. This is reflected in the uptrend of the spread since its low of (-22) cents (the unusual situation of cash HRW wheat priced higher than HRS). Waiting for Thursday evening's index calculations, the spread has moved back out to 23 cents (HRS over HRW).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Now to analyze the situation: The spread has been in a strong major (long-term) downtrend since its peak of $2.89 in early June 2011. Connecting the subsequent highs results in a solid downtrend line (red dashed line) that puts trendline resistance this week at the $0.41 level.

Also notice that this cash market spread has moved up into resistance between $0.12 and $0.30. These prices mark the 33% and 50% retracement levels of the previous secondary (intermediate-term) downtrend from the high weekly close of $0.82 (week of July 1, 2013) through the aforementioned low posted the week of October 21, 2013. Trendline resistance crosses the 50% retracement resistance the week of February 24, 2014, giving us a time target as well as a price target.

Lastly, take note of weekly stochastics (bottom study) associated with this spread. After establishing a bullish crossover (faster moving blue line crossing above the slower moving red line) well below the oversold level of 20%, in conjunction with the low on the price chart, weekly stochastics are now showing an overbought situation above 80% indicating the uptrend could soon come to an end.

From a fundamental point of view this would indicate that merchandisers should soon uncover enough higher protein wheat to meet demand, leading to a weakening of the cash hard red spring wheat market against the cash hard red winter market. Also note that while this spread has rallied of late, it remains historically low due to the abundance of higher protein winter wheat harvested the last few years.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .