Technically Speaking

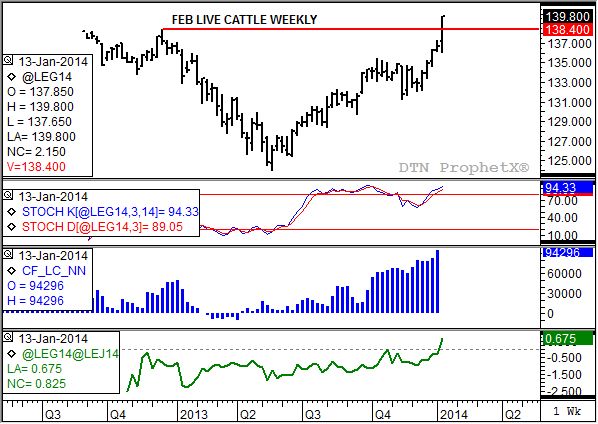

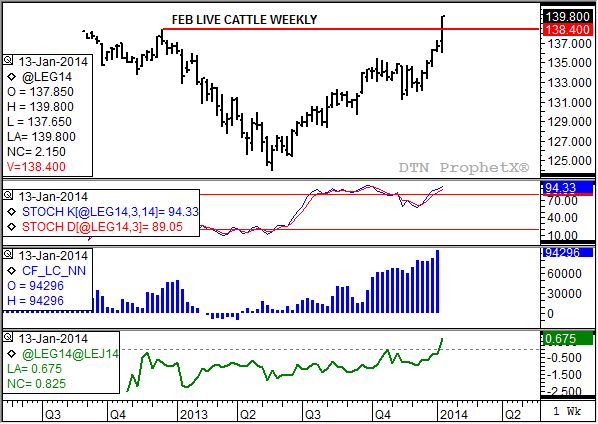

Feb Live Cattle: The Picture of a Bullish Market

The unofficial rule of thumb when it comes to blogging for DTN is to try to hold the commentary to anywhere from 300 to 500 words (though I often break this quasi rule). If the old adage "A picture is worth a thousand words" still rings true, then the February live cattle weekly chart has me covered for the next couple of days. Enjoy.

What's that? You want a little explanation with the chart? Okay, but I'll keep it short.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feb cattle blasted to a new high of $139.90 Wednesday (as of this writing), easily surpassing the previous high of $138.40 (top chart, red line) set the week of December 17, 2012. The contract is being pulled higher by strong buying from both commercial and noncommercial forces.

Those familiar with my analysis will recognize this as my take on structural analysis. Noncommercial traders continue to add to their net-long futures position (numbers from weekly CFTC Commitments of Traders reports, third study, blue histogram).

On the other hand, the commercial view of supply and demand continues to grow more bullish as the February contract strengthens against the April contract (Feb to April spread chart, bottom study, green line). Wednesday's trade of a $0.75 premium (Feb over April) is light years above the five-year average for this week of a $3.88 discount (Feb under the April).

Given that the contract is technically overbought, indicated by weekly stochastics (second study) well over the 80% level, the uptrend in the market could soon come to an end. However, it is a good policy to never step in front of a runaway train. If you don't get anything else from this blog, always remember that.

Wait for signals that the commercial bullishness has run its course, usually indicated by basis (the difference between cash and futures prices) beginning to weaken and/or the futures spread changing direction. Until then, if supply and demand wants to spook the cattle market, let the stampede run.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .