Technically Speaking

March Feeder Cattle Nearing a Trend Change

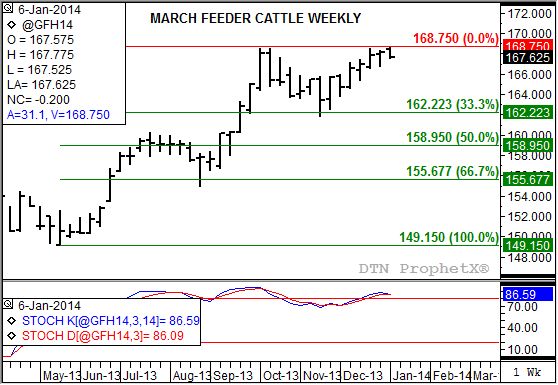

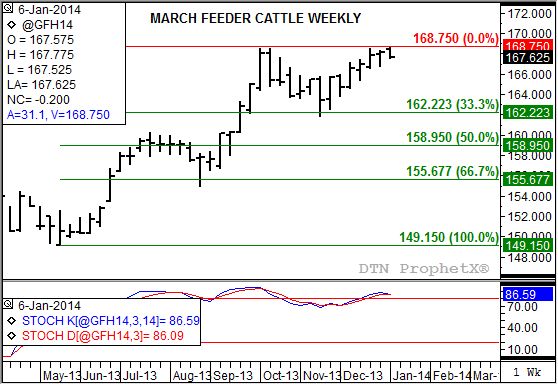

The feeder cattle market has been bullish for months, with the more active March contract establishing a new high of $168.75 earlier this week. However, since peaking, the contract has been moving lower putting itself in position to establish a secondary (intermediate-term) downtrend. The key could be if it falls below last week's low of $166.775.

If you take a look at the attached weekly chart, you should see the pattern that appears to be forming. If the March contract takes out last week's low and then closes below last week's settlement of $168.10, a clear bearish key reversal would be established signaling a move to a downtrend.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Along with the potential bearish pattern on the contract's chart, weekly stochastics (bottom study) are nearing a bearish crossover. This means the faster moving blue line is nearing a move below the slower moving red line, with both above the overbought level of 80%. If this occurs in conjunction with a bearish key reversal by the futures market, it would confirm the idea the next move in March feeder cattle should be down.

Taking all that into consideration, initial technical price support would be pegged near $162.25, a price that marks the 33% retracement level of the previous uptrend from $149.15 through this week's high of $168.75. Given that the feeder cattle market remains fundamentally bullish, as indicated by futures spreads (not shown), the total retracement shouldn't move much below the 50% level of $158.95.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .