Technically Speaking

March Beans Turning Up? Looks Like It

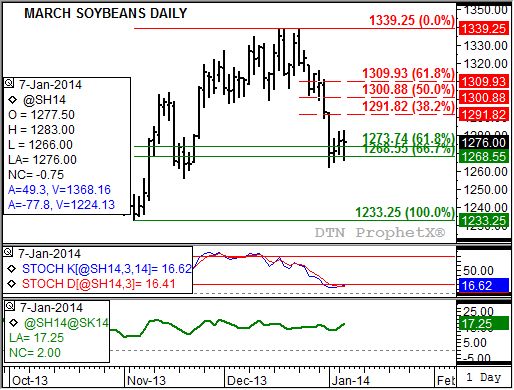

Which came first, the chicken or the egg? Or in the case of the March soybean contract, the bullish crossover by its daily stochastics or a bullish technical signal on its daily chart? A look at said daily chart shows the answer to be daily stochastics.

Not to say that it wasn't close, with the contract coming within fractions of establishing a bullish outside day. After trading below Monday's low of $12.69 1/4 March soybeans rallied above Monday's high of $12.82 1/4, posting a high of $12.83 Tuesday. All that was needed was a higher daily close to complete the pattern, and with mere minutes left before the closing bell the contract was trading higher. But a last round of sell orders in otherwise low volume trade led to a final drop.

Despite this late development, daily stochastics did complete a bullish crossover Tuesday. The faster moving blue line finished above the slower moving red line, with both below the oversold level of 20%. Looking back over the history of the contract, both bullish and bearish crossovers by stochastics have been fairly reliable indicators of a change in trend, regardless of patterns by the futures contract.

If the minor (short-term) trend has turned up for March soybeans, the initial price target looks to be near $12.91 3/4. This price marks the 38.2% retracement level of the previous downtrend from $13.39 1/4 through last week's low of $12.62 1/2. However, given the renewed support of the commercial side of the market, as indicated by the strengthening inverse of the March to May futures spread (bottom study, green line), the contract could test its 50% retracement level near $13.01.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\Darin Newsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .