Technically Speaking

Corn Spreads Moving Sideways

As I talked about in Tuesday's (November 26) On the Market column, "The Titanic", the corn market is staying afloat because of support from the commercial side of the market. National average basis remains firm with the DTN National Corn Index (national average cash price) holding at 21 cents under the March contract. This is roughly 4 cents stronger than the five-year average of 25 cents under despite the fact USDA is projecting record production and total supplies, and near record ending stocks for the 2013-2014 marketing year.

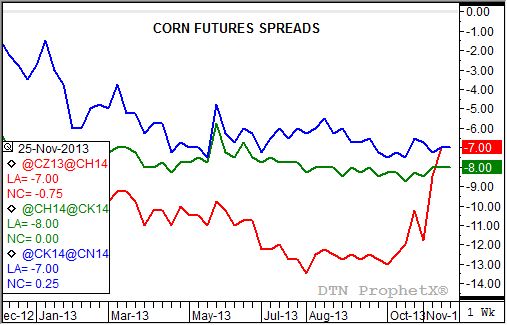

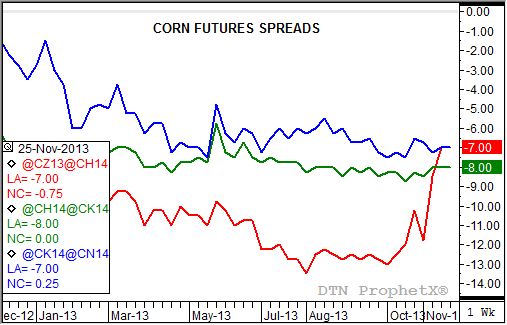

We also use futures spreads (price differences between contracts) to read the market's view of supply and demand. If the deferred contract holds a strong premium over the nearby contract, a carry situation, the market's view of fundamentals is considered neutral to bearish (generally). The stronger the carry, the more bearish the fundamental outlook is. Using a chart showing these spreads, an increasingly bearish spread will show a downtrend, meaning the nearby contract continues to lose ground to the deferred contract.

A look at the chart for the 2013-2014 corn futures spreads shows the trend to be sideways for both the March to May (green line) and May to July (blue line). As with most sideways trends, this reflects a period of indecision by the commercial side of the market as they continue to see how this year's cards are played.

If USDA is right though, and supply and demand is so decidedly bearish, why aren't the spreads trending down? As I talked about in the column, there are a couple of reasons. First, the futures market has slowly been grinding lower. Remember that the degree of bullish, bearishness, or neutrality of a spread is gauged by how much of the total cost of carry (total cost of holding grain in commercial storage), by percent, the spread covers. Therefore, if the nearby futures contract (e.g. March corn) moves lower while the corresponding futures spread (e.g. March to May) holds steady, the spread actually accounts for a higher percent of the total cost of carry, and therefore reflects a more bearish supply and demand situation.

The second possible reason is that farmers are refusing to sell grain at this time because of a) the low price of the market, and b) many don't need the income in 2013. This forces commercial traders to support the spreads and basis in an attempt to source enough supplies to meet demand.

As for the trend in the spreads, after all this is a blog about technical things, keep an eye on some key levels in the March to May and May to July spreads. Support in the former is at the 8 3/4 cent carry level, with the previous low in the latter at 7 1/2 cents carry. A move below these marks would indicate a downtrend has begun, likely reflecting an increasingly bearish commercial outlook.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\Darin Newsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .