Technically Speaking

Time for Another Rally in Dec Chi Wheat

Anyone who has watched the Chicago wheat market of late knows it has had a devilish time trying to build bullish momentum. As discussed in Tuesday's Early Word Grains on DTN, the market saw a rally from mid-September through mid-October as noncommercial traders moved from a net-short futures position to a net-long futures position. Then, just as quickly, the market fell again as this group reestablished a net-short futures position.

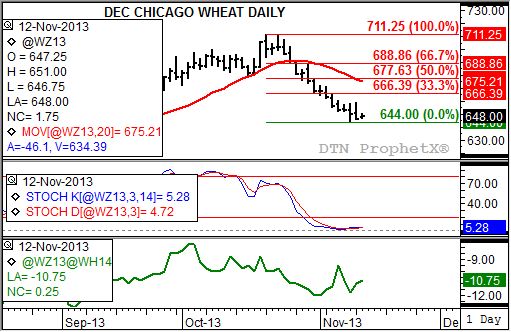

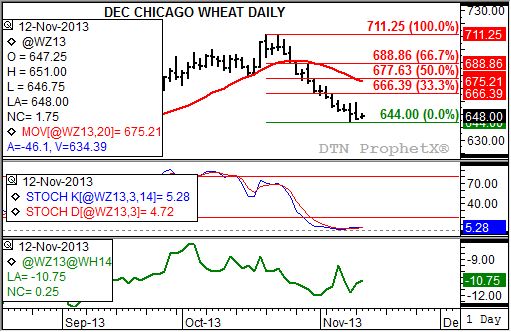

A look at the daily chart for the December Chicago wheat contract shows the struggles the market has faced of late. After posting a high of $7.11 1/4 on October 21, the contract steadily eroded to a low of $6.44 on Friday, November 8. This week, so far, the contract has stabilized above its recent low.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Daily stochastics (second study) show that the contract may be in the process of establishing a minor (short-term) uptrend. This momentum study appears to have made a bullish crossover (faster moving blue line crossing above the slower moving red line) well below the oversold level of 20% (both are in single digits, 5.2% and 4.7% respectively). And while the futures contract itself has not established a bullish technical signal, stochastics could be a leading signal of a short-term change in noncommercial sentiment.

If December Chicago wheat has turned a bullish corner, the upside seems to be limited by the market's neutral to bearish view of supply and demand indicated by the sideways trend in the Dec to March futures spread at a relatively strong carry level (bottom study). Given the commercial outlook, the initial upside target is near $6.66 (devilish, get it?), a price that marks the 33% retracement level of the previously mentioned downtrend. Also, the 20-day moving average (thick red line, top chart) continues to come down and is already calculated below the 50% retracement level near $6.77 1/2.

Yes, December Chicago wheat appears poised for another minor rally, with its upside price potential blocked by bearish fundamentals. If futures spreads turn more bullish, it could open the upside slightly. Stay tuned.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .