Technically Speaking

Soybean Trends for 2013

As I discussed at the recently concluded DTN/The Progressive Farmer Ag Summit and in last week’s On the Market column, the major (long-term) trend of soybeans remains down. That’s not to say the market can’t rally, given that the secondary (intermediate-term) trend has turned up.

Let’s take a look at the secondary trend first. As I pointed out in the post from December 1, 2012, “Jan Beans’ Bullish Signal”, weekly stochastics saw a bullish crossover below the oversold level of 20% indicating the trend had turned up. The same was true in the more active March contract. Since then the noncommercial long-futures position has slowly grown larger, with last Friday’s report showing this group holding 189,746 contracts (as of Tuesday, December 11), up 5,938 contracts from the previous week. Commercial traders have also grown more bullish, with the inverse in the March to May futures spread strengthening from 16 1/2 cents in mid-November to 20 cents at last Friday’s close.

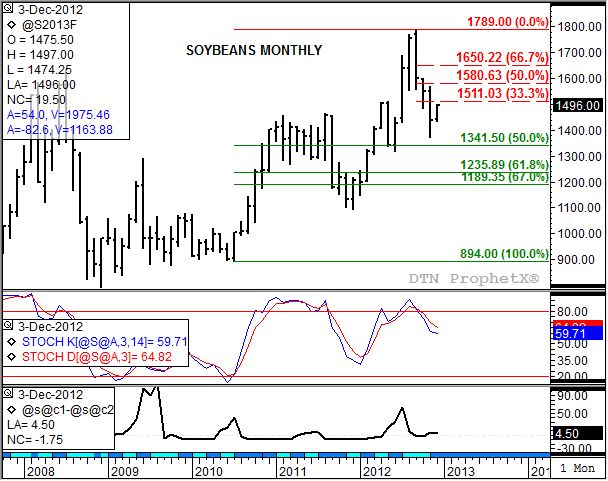

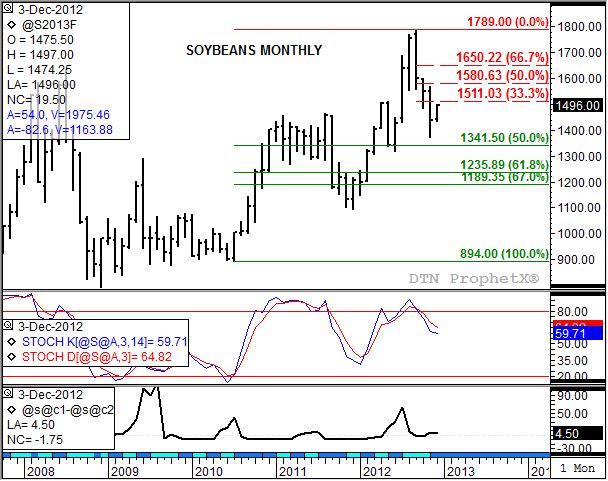

Be that as it may, the secondary signals have not offset the major turn signal posted on the monthly chart (shown) this past September. After establishing a high of $17.89 early in the month, the more active contract fell to a test of the August low of $15.55 1/4 before closing $1.55 1/2 lower for the month. Note that this coincided with a bearish crossover in monthly stochastics (middle study) where the faster moving blue line moved below the slower moving red line above the overbought level of 80%. Since then, the market fell to a low of $13.72 1/4 in November, a test of the 50% retracement level ($13.41 1/2) of the previous uptrend from $8.94 low posted in July 2010 through the September 2012 high of $17.89.

Given the still bullish inverse in the futures spreads (bottom study, nearby futures spread), the secondary uptrend would be expected to retrace at least 50% to as much as 67% of the initial selloff. This puts the price target between $15.80 and $16.50, most likely occurring in the first-quarter of 2013 meaning the March 2013 contract (closed Friday at $14.91 1/2).

At that point the market is expected to get interesting. Keep in mind that South American new-crop supplies are expected to become available in mid-March, possibly changing the commercial outlook to bearish. If so, the nearby futures spread (at that time, the May to July spread that closed Friday at an 18 1/2 cent inverse) could be back to near par ($0.00) if not in a small carry (July contract higher priced than the May). If so, by late 2013 (either the January 2014 of March 2014 contracts) could be testing major support between $12.35 and $11.89, the 61.8% and 67% retracement levels of the previously mentioned major uptrend.

Using a simple measuring technique of taking the initial selloff of about $4.17 ($17.89 through the low of $13.72) and subtracting it from the projected high of $16.50 puts the target for the second leg of the downtrend near $12.33. If the spring rally stops near $15.80 the downside target becomes $11.63. This technique would seem to confirm the retracement support mentioned above, with the higher probability the combination of a spring high near $16.50 leading to a fall/winter low near $12.35.

ITo track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .