Fundamentally Speaking

Corn Yelds in Top Exporting Countries

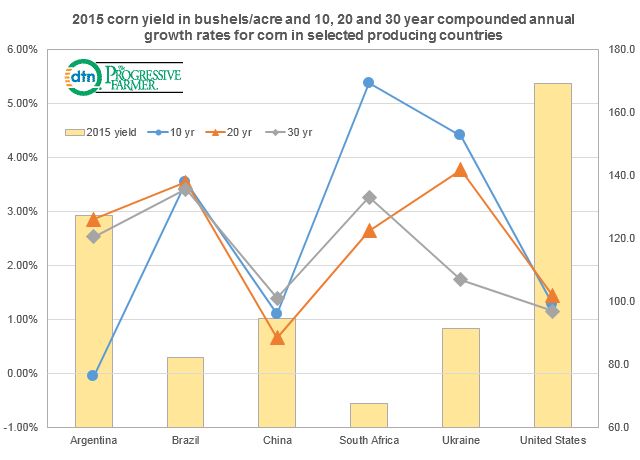

By using its comparative advantage in producing corn via use of the best seeds, inputs and technology, the U.S. has much higher corn yields than any other exporting nation.

This chart shows the 2015 corn yields for the U.S. and a number of other countries in bushels per acre.

The 10, 20 and 30 year compounded annual growth rates (CAGR) for corn yields are also reported.

Even though the U.S. does have the highest corn yields, the rate of growth in yields is well below those of other countries, though we are starting from such a high level.

This is particularly true for Brazil, South Africa and Ukraine.

Though China reportedly has huge domestic stockpiles of corn, this is based more on large tracts of harvested area as opposed to higher yields as severe pollution and their refusal to use GMO seeds has constrained their yield growth.

Argentina is another interesting story as their 10 year CAGR lags behind their 20 and 30 year CAGR by a wide margin as the onerous export tax on Argentine corn has stymied new research and investment to enhance yields, though with a new President this may change.

(KA)

© Copyright 2015 DTN/The Progressive Farmer. All rights reserved.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .