Fundamentally Speaking

Stock Market Influence on Commodity Prices

These days it appears that the fundamentals or technicals do not matter with the direction of the grain and oilseed markets increasingly dictated by the movements of the U.S. and global equity markets, especially over the past two weeks.

The decision by China to devalue their currency has brought to the forefront the sobering realization that this country, the world's most populous nation consuming more commodities than any other country and the planet's second largest economy after the U.S. is in danger of seeing growth slow far more than the 7.0% projected expansion for 2015.

A correction in the Chinese stock markets that was already in place even before yuan depreciation from sharp gains scored earlier in the year has been accentuated by concern about flagging growth and this meltdown in share prices has rippled across most major bourses throughout the globe.

Just in the U.S. the stock market crash has supposedly wiped out over five trillion dollars' worth of value.

Given this situation we were curious to see the impact of stock market movements on some key commodity markets.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

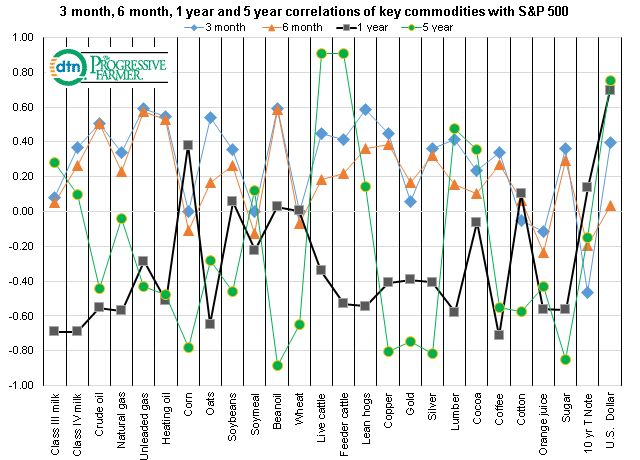

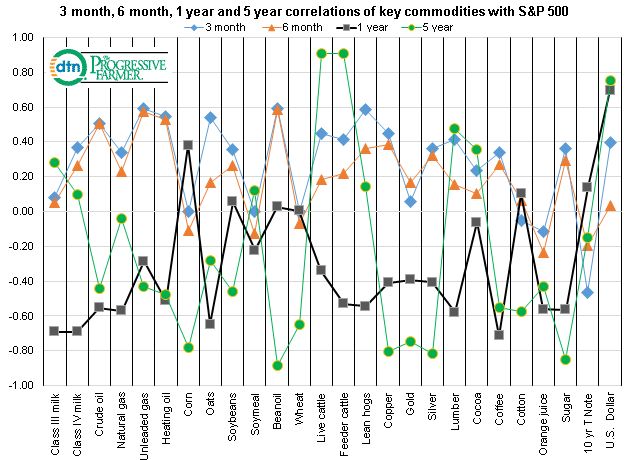

This piece shows the coefficient of correlation for a number of commodities measured against the daily movements of the cash S&P 500 index.

We examined the results for a number of commodity markets including the grain and oilseeds complex, precious metals, industrial commodities, energy markets, livestock and the softs.

Also included were the daily movements of the cash U.S. dollar Index and the cash 10 year U.S. Treasury notes.

The correlation coefficients were run for periods of three months, six months, one year and five years.

Just focusing on the five year we see that live cattle, feeder cattle and the ten year Treasury notes have the highest correlations.

On the surface this is not too surprising as beef consumption is thought to be correlated with the health of the general economy and with the U.S.

GDP expanding over the past five years this has resulted in more jobs resulting in greater personal income, increased consumer confidence and restaurant patronage.

The high correlation with T-notes is based on the low long-term interest rates that have been positive to the stock market and bond prices.

As for negative correlation the -0.75 five year correlation with gold makes sense as gold is seen as a safe haven in times of turmoil and turmoil is not something the stock market likes.

One final thought is that the stock market gyrations must be having some impact on commodities in general as the 3 month correlation coefficient is much higher for a number of markets than is the 6 month one year and five year figures.

(KA)

Comments

To comment, please Log In or Join our Community .