Fundamentally Speaking

Late July Export Pace for Corn & Beans

The slide in most grain and oilseed values continued this week albeit at a slower pace as the markets may become more range bound heading into the August 12th crop production report.

The theme remains the same with very high or even record row crop yield potential in many states west of the Mississippi with more much uncertainty as to acreage and yields from Illinois east.

Receiving a lot of attention this week has been the slide in other markets with key commodities such as gold and crude oil posting severe losses over the past few weeks with some major commodity indices now at their lowest levels in 14 years.

A resurging dollar in the foreign exchange markets that is inherently bearish to commodities, the prospect of the first U.S. interest hike in ten years and a dramatic slowing of the Chinese economy are some of the main reasons for this price weakness.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The grain and oilseed markets are also focusing on what is shaping up to be poor demand with beef and pork prices tumbling along with dairy values undermining feed consumption, ethanol margins pressured by a drop in gasoline and distillers grain prices and U.S. export sales of new crop corn and soybeans the lowest in years.

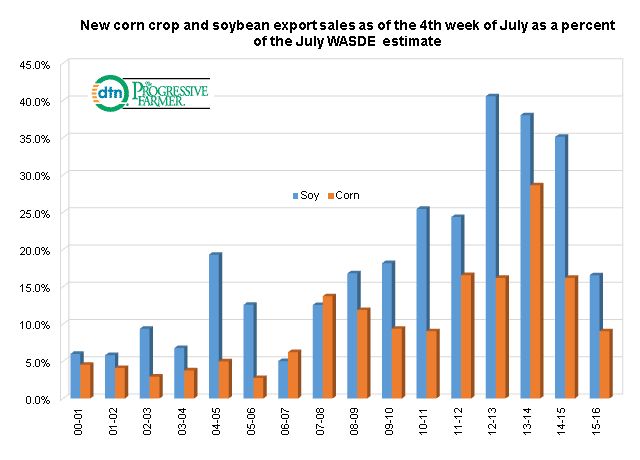

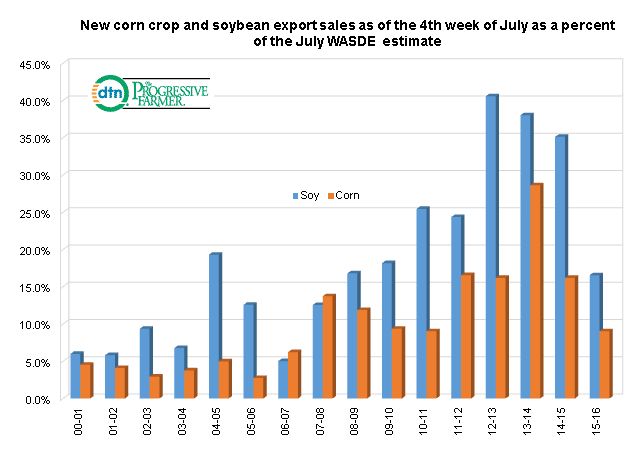

The accompanying graphic highlights the latter point showing new crop (marketing year starting September 1) corn and soybean export sales as of the fourth week of July as a percent of the July USDA WASDE export projection.

This week's export sales report puts total new crop corn sales at 169.2 million bushels, 9.0% of the 1.875 billion export projection. This appears to be at the same slow pace as last seen in the 2010/11 season and before that 2006/07.

This week's export sales report also showed cumulative new crop soybean sales at 293.7 million bushels, a mere 16.5% of the July 2015 WASDE export projection of 1.775 billion bushels.

This is the lowest pace for new crop soybeans as of the fourth week of July since the 2007/08 season with trade noting the 2015/16 sales pace less than half seen a year ago.

Clearly there is a much more complacent buying attitude among world importers based on very large and in the case of oilseeds, record stocks and stock to use ratios.

Record corn and soybean production in South America over the past few years is proving stiff export competition to our overseas sales that are also depressed by the previously mentioned strong dollar.

(KA)

© Copyright 2015 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .