Fundamentally Speaking

Corn Acreage Changes in Top States

Corn futures have broken down over the past week trading below the lower level of a range that has been in place since the beginning of the year.

Increasingly bearish assessments of demand has been the primary driver with ten year lows in ethanol prices undermining production of that fuel, cheaper offers out of the Black Sea and South America depressing our export sales and fears the 3/31 quarterly stocks report may report a disappointing implied feed usage figure similar to the Dec 1 report.

New crop futures have also been dragged down with the December 2015 contract now at its lowest levels since late October.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

We suspect that the recent slide should soon abate heading into the key Prospective Plantings report also to be released on the 31st with the trade looking at a fourth consecutive year of declining U.S. acreage.

Additional support may derive from the fact that in four of the past five years final corn planted area has been below the March intentions report by an average very close to one million acres.

Much of this is linked to late plantings with just 33% of the intended U.S. acreage planted by May 5th a year ago, 12% as of that date in 2013 and 28% in 2011.

In prior pieces we noted that the current abnormally dry conditions in the Upper Midwest may be a blessing in disguise for this is where some intended corn ground has not been planted in recent seasons.

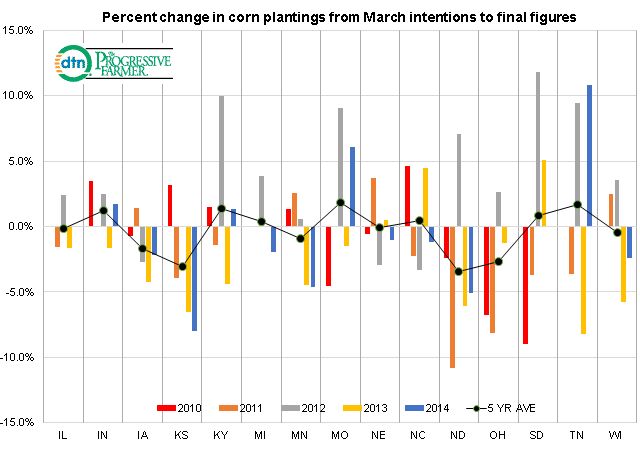

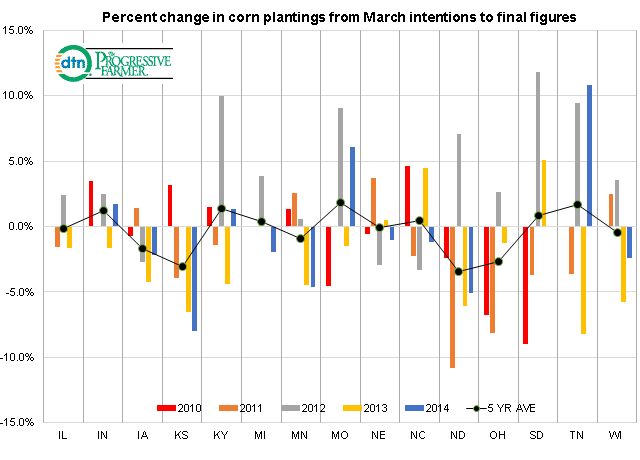

The accompanying graphic shows the percent change of corn planted acreage from the March intentions report to the final figures for the top 15 producing states of both corn and soybeans for each year from 2010 to 2014 along with the five year average.

Concerns about wet and cold conditions in the Upper Midwest appear justified with North Dakota seeing actual corn plantings fall short of March intentions by an average of 3.5% over the past five years including a 6.1% and 5.1% shortfall the past two years.

MN also saw 2013 and 2014 final corn plantings decline by 4.4% and 4.7% from the March intentions respectively.

OH and KS are also two other states that have a tendency for final corn acreage to come in below what is indicated in the Prospective Plantings report along with IA and WI.

(KA)

Comments

To comment, please Log In or Join our Community .