Fundamentally Speaking

Prospective 2015/16 Soybean Stocks

November 2015 soybean futures are back in retreat after staging a $1.28 per bushel rally from the $9.27 contract low established late September last year.

Pressuring values has been the likelihood of a third consecutive record South American soybean crop, some large Chinese cancellations of U.S. soybeans purchased earlier in the year and expectations that U.S. soybean plantings this spring could increase substantially above the already record 2014 acreage figure.

Note that even with record demand, U.S. soybean ending stocks for the 2014/15 season are pegged at 410 million bushels and that would be the highest since 574 million bushes were seen back in the 2006/07 season.

This year's carryout as a percent of total consumption is 11.2%, also the highest in eight years.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

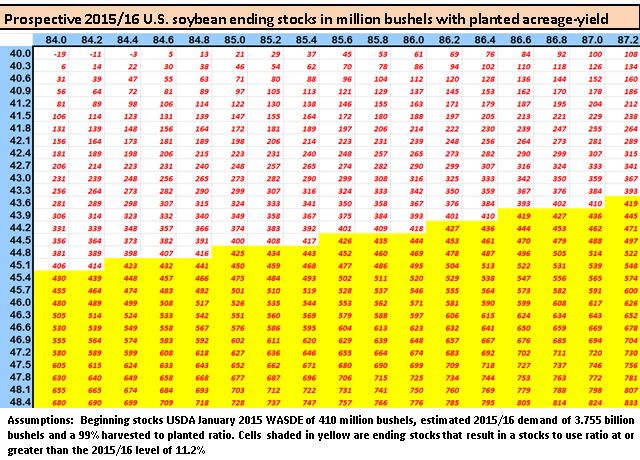

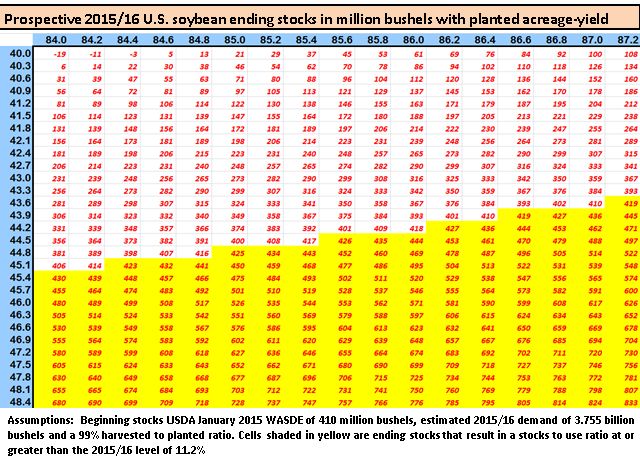

As we did in an earlier piece on corn, this graphic shows the prospective 2015/16 U.S. soybean ending stocks figures based on various combinations of planted acreage numbers going across the x-axis in millions and yields going down the y-axis in bushels per acre (bpa).

Assumptions include a beginning stocks figure of 410 million bushels which is the last USDA estimate for this year's ending stocks given in the January 2015 WASDE report.

We estimate next year's demand at 3.755 billion bushels which is the compounded annual growth rate of soybean demand over the past ten years times this year's total consumption.

The harvested acreage figure is the recent harvested/planted ratio of 99% times the planted figure.

Each cell has the figure of 410 million bushels plus estimated production which is the planted area multiplied by 99% multiplied by the yield less the estimated demand of 3.755 billion bushels.

Finally those cells shaded in yellow are when those stocks as a percentage of the estimated total usage is greater than or equal to this year's stock to use ratio of 11.2%.

With the November 2015 soybean/December 2015 corn ratio having fallen rather steeply over the past few weeks, 2015 soybean area may not expand as much as had been anticipated but an 86.0 million acre figure seems to be the consensus.

We also feel the USDA will use a projected 20`15 national yield of 45 bpa that would result in ending stocks close to 460 million bushels, certainly higher than this year though well below the 550-600 million that some had seen.

Should we get yields to approach last year's high of 48.8 bpa then ending stocks could climb to very burdensome levels both in aggregate and as percent to usage terms.

(KA)

© Copyright 2015 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .