Fundamentally Speaking

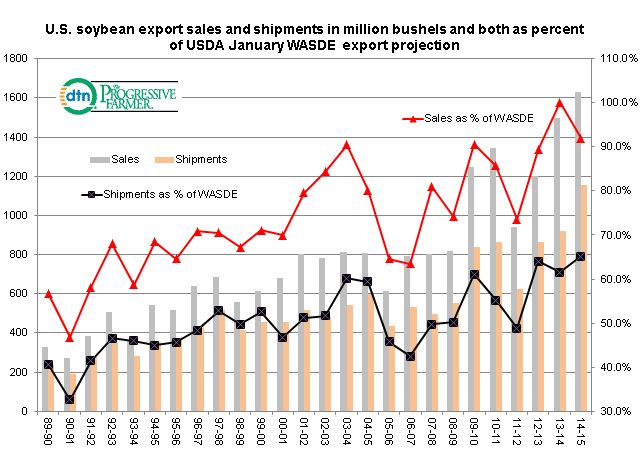

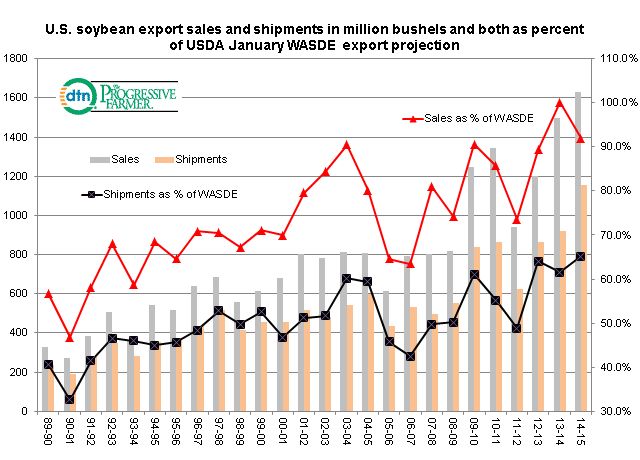

U.S. Soybean Sales & Shipment Pace

The USDA is forecasting yet another record soybean harvest out of both Brazil and Argentina based on an increase in planted acreage and generally favorable weather.

In recent years these supplies have been augmented by rising output in other South American countries such as Bolivia, Paraguay and Uruguay.

In thirty years, combined output of these five countries has increased from 25% of total global soybean output to as high as 62% while their combined share of global soybean trade has risen from 16% to as high as 59%, all at the expense of the U.S.

Despite this somewhat sobering fact about the U.S. ceding both soybean production and exports to South America, the fact is that global soybean demand has risen at such a dizzying pace over the past twenty years (thanks mainly to China) that the U.S. has been able to increase its export totals even as South America does the same.

The USDA has projected 2014/15 U.S. soybean sales record high, but through the second week of January, those sales as a percent of the USDA January WASDE projection of 1.770 billion bushels are 92.0%, the second highest ever for this time of year behind the year ago sales pace while total shipments are 65.1% of this total, the highest ever.

This augurs for the USDA to increase its export estimate in subsequent WASDE reports.

Reasons for this impressive performance in light of South American competition and the headwinds created by the strong U.S. dollar include insatiable demand by China and concerns about the ability of South American countries to load and ship contracted soybeans on a timely basis.

Note that over the past ten years the US has increased its export projection by an average of 56 million bushels from the January WASDE export projection to the final figures.

(KA)

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .