Fundamentally Speaking

Dollar Rally Making US Beans Uncompetitive

The U.S. soybean and meal export pace so far this marketing year has been robust with our offers quite competitive vis-à-vis those of our competitors at least through January.

Beyond that both Argentina and Brazil should garner the lion's share of business for the rest of 2015 into early 2016 if forecasts of record soybean production from each come to fruition.

The USDA is pegging Brazilian and Argentine output at 94.0 and 55.0 million metric tons, new highs above last year's record respectively.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

So far weather in each country has been about perfect with a timely mix of rain and sun and if this continues these all-time high crop estimates could move even higher.

Another consideration is the unrelenting strength of the U.S. dollar in the foreign exchange markets with the U.S. dollar index having pushed to five year highs.

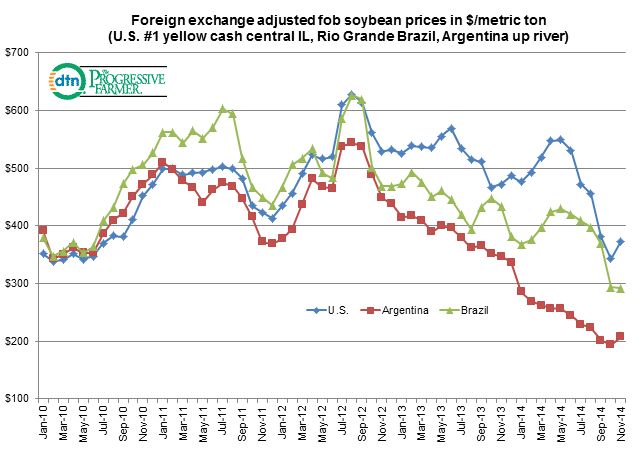

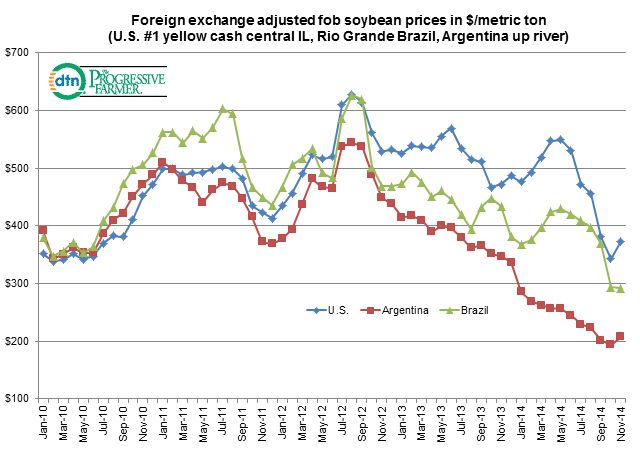

The Argentine peso and Brazilian real have lost 54% and 32% of its value vs. the greenback respectively since January 2010 making their soybeans much cheaper to foreign buyers when those peso and reals are converted to dollars.

The chart on the prior page shows fob soybean values and now Argentine and Brazilian prices are so much cheaper though farmers in each country are hanging onto their beans as their falling currencies provide incentive to retainpossession for as long as possible.

This has been upsetting to the Argentine government as they are desperate for hard currency and the hoarding of the soybean crop by their farmers is limiting the amount of export taxes taken in.

Taken together, the prospect of a third straight year of record South American soybean production along with the foreign exchange considerations suggest U.S. overseas sales of both soybeans and meal could rally tail off significantly after the first of the year.

(KA)

Comments

To comment, please Log In or Join our Community .