Fundamentally Speaking

Foreign Exchange Adjusted Corn Prices

U.S. corn prices have come down substantially from where values traded at the beginning of last year and that should have buoyed our export sales.

For the 2013/14 season, they were an impressive 1.917 billion bushels, up a stunning 262% from the 730 million bushels shipped overseas the prior year, a 43 year low.

Of course our sales in the 2012/13 season were victimized by the drought reduced crop that year.

Interestingly, even with corn prices forecast 21.5% lower this year than last, the USDA is projecting exports at 1.750 billion bushels and that is down 8.7% from the prior season.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Actually given the sluggish sales pace over the past few weeks, it appears trade consensus is that actual sales could fall 100 million or more below this level.

One reason is large supplies of corn in other exporting nations and regions that are competing very aggressively for customers.

Another consideration is the surge in the U.S. dollar to at least five year highs based on the trade weighted dollar index with the appreciation vs. other specific currencies even greater especially vs. Japan where the greenback is now at a seven year high vs. the yen.

Though economists state that foreign exchange considerations only have a slight impact on trade flows the dollar rally has not helped our export situation.

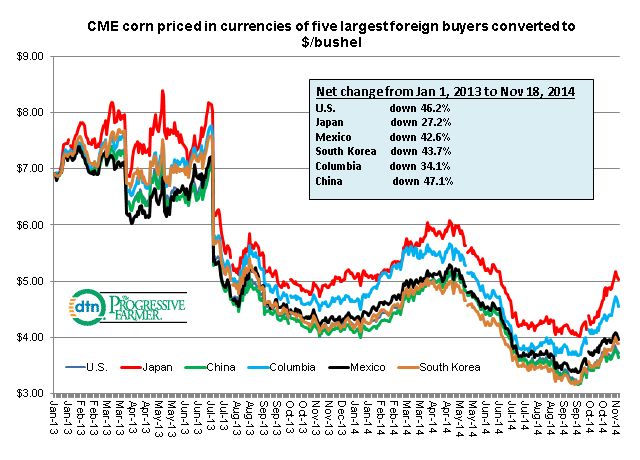

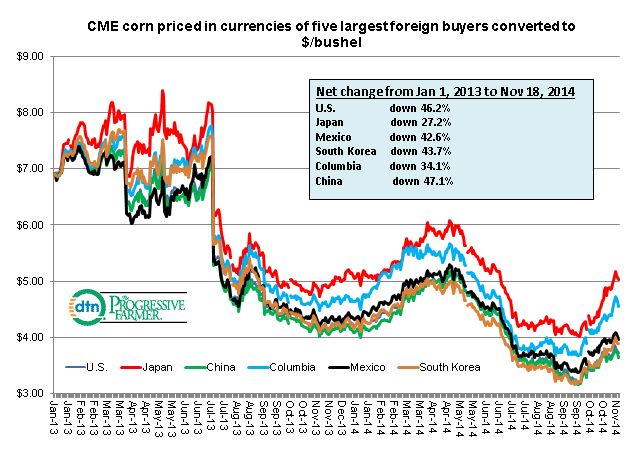

This graphic shows continuous CME corn futures priced in the currencies of our five largest foreign corn buyers; Japan, Mexico, China, Columbia and South Korea from 1/1/13 to 11/18/14.

Though nominal corn prices have receded, the decline in exchange adjusted prices depends on how the respective currencies have fared vs. the dollar over the past 23 months.

The strength of the dollar vs. the Japanese yen and Columbia peso means that CME corn prices have sunk 46.2% in U.S. dollar terms, they have only declined 27.2% and 34.1% respectively for Japanese and Columbia buyers.

The appreciation of the Chinese yuan to the dollar unfortunately has had little positive impact on our sales to the world's largest corn consumer given their de facto boycott on U.S. corn due to certain GMP issues and reportedly huge stockpiles in China itself.

(KA)

Comments

To comment, please Log In or Join our Community .