Fundamentally Speaking

Late Oct Soybean & Soymeal Exports

October provided more trick than treat to oilseed and protein meal end-users with soybeans up $1.28 and soybean meal up $90 per ton since the start of the month.

A combination of robust early season export sales for both soybeans and soybean meal, record crush margins, light farmer selling, super strong feeding margins and major transportation snarls emerging this early in harvest has sent nearby soybean and meal basis levels surging boosting futures prices of all soycomplex members.

Despite the record oilseed production coming out of South America and their lower prices especially given the weakness in the Brazilian real and Argentine peso vis-à-vis the U.S. dollar the export pace for both soybeans and meal has been off the charts.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

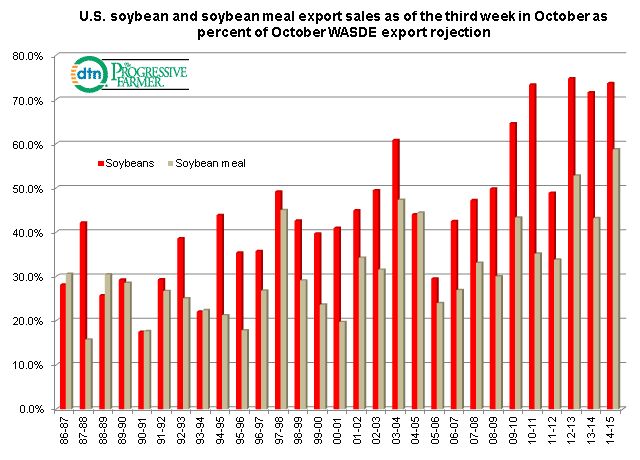

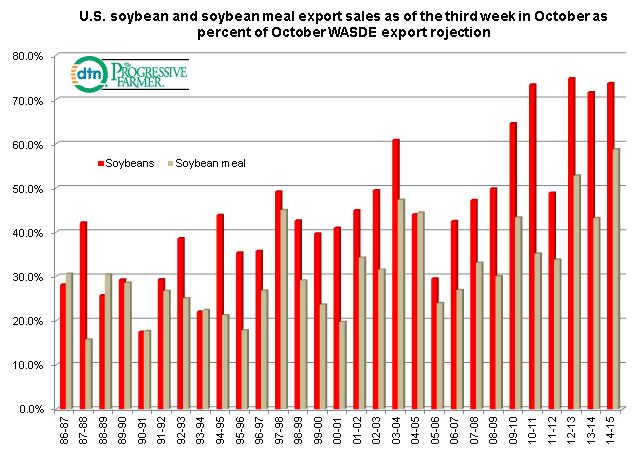

The accompanying graphic shows total soybean and soybean meal sales as of the third week of October as a percent of the USDA October WASDE export forecast.

Soybean exports once again are projected at an all-time high of 1.70 billion bushels, up 53 million from last year's record.

Note that through the third week of October, soybean commitments are already at 1.253 billion bushels and this represents 73.7% of total year sales, a figure that is only second to the 74.8% percent scored in the 2012/13 season.

With soybean sales this strong a mere six weeks in the marketing year it is almost assured that the USDA will hike its export projection in future WASDE reports.

Export demand for U.S. soybean meal is estimated at 12.0 million tons, up 500,000 from last year at a new record exceeding the 11.159 million in the 2009/10 season.

With the soybean meal marketing year starting the beginning of this month, the sales to date at 7.045 million are a whopping 58.7% of the USDA final year projection strongly intimating that this export figure also will be hiked in coming S&D reports.

(KA)

Comments

To comment, please Log In or Join our Community .