Fundamentally Speaking

U.S. & Foreign Corn Yield Trends

Last Friday's WASDE report seemed constructive for corn on the surface with 2013/14 U.S. stocks pared by a much higher than anticipated 185 million bushels.

With two-thirds of the marketing year passed, the carryout is much closer to one billion bushels as opposed to the two billion forecast last fall.

Instead, the market chose to focus on the much more bearish new crop outlook and the revised 10 million metric ton increase in global corn stocks for this year and the forecasted rise to 182.0 million next year that, if confirmed, will represent the highest level of world corn stocks since the 1999-2000 season.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In the case of the U.S., forecasted record production and a drop in demand is behind the rise in stocks while record global production is also predicted for the 2014/15 season.

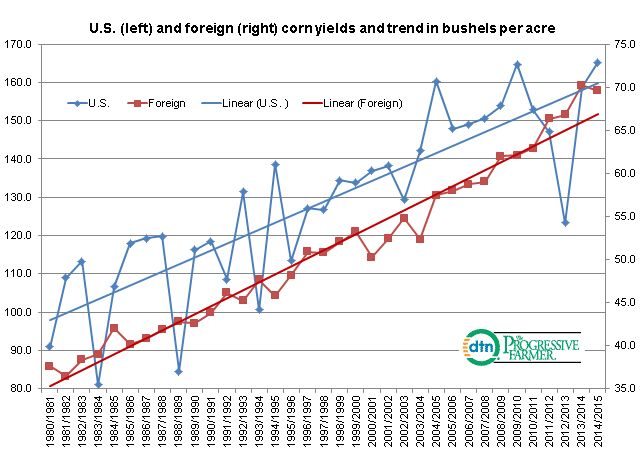

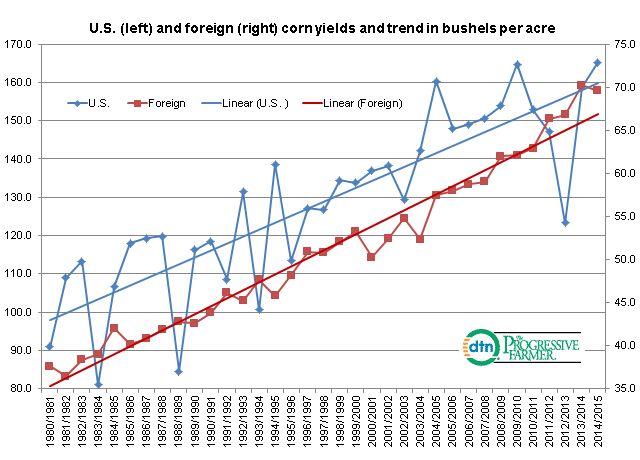

The accompanying graphic that shows both the U.S. and foreign corn yields in bushels per acre along with their respective 1980-2013 trend, the USDA has set the bar very high this year as far as yields are concerned.

For the U.S., they are using a record 165.3 bushel per acre (bpa) figure that would top the prior peak of 164.7 bpa seen in 2009.

They are also incorporating the second highest foreign corn yield ever at 69.6 bpa, below the year ago 70.2 bpa but still the fourth straight year of above trend yields, a feat not witnessed in over 30 years.

For the U.S. the fact that 2014 corn plantings are proceeding at least at an average pace bodes well for yields along with indications that an El Nino weather phenomena may be forming, an event that in the past has correlated to above trend U.S. row crop yields.

Of course, weather in the summer, specifically temperatures and rainfall, will be the ultimate arbiter of what final corn yields are like, both here and abroad.

(KA)

© Copyright 2014 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .