Fundamentally Speaking

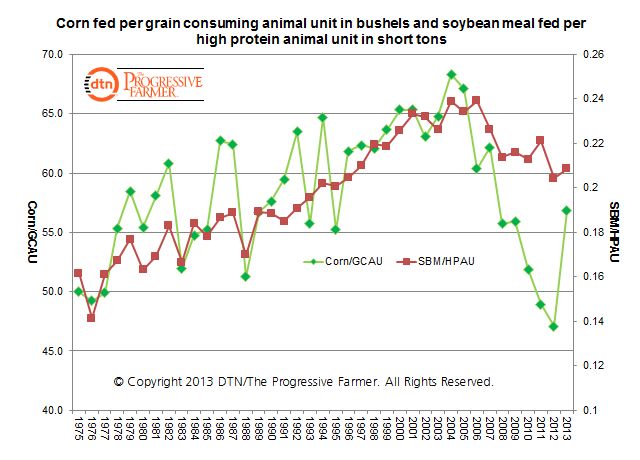

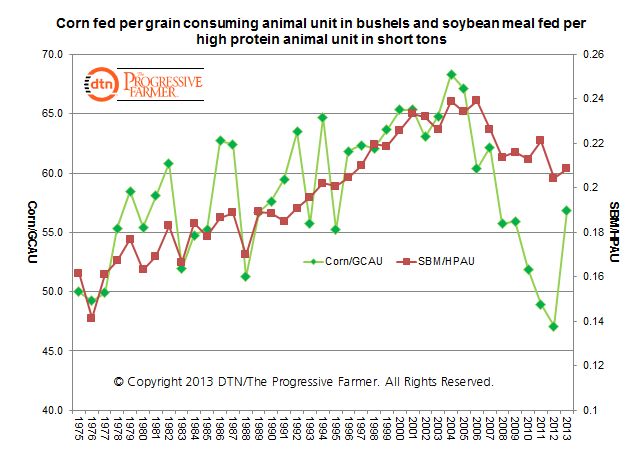

Corn & Soymeal Usage for Animal Feed

The latest U.S. corn supply-demand report showed less of an increase in estimated 2013-14 ending stocks than had been anticipated.

Part of this as noted in an earlier piece was a 1.90 million bushels acre reduction in planted area from the August to the November crop production reports, the largest decline ever recorded between these two months.

Second are some rather optimistic demand projections by the USDA where total demand is pegged 16.6% greater than the prior year, the third highest year-to-year increase ever and the largest since 1994.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Of note is the forecasted 20.0% increase in projected feed/residual usage, the largest increase ever topping the 18.6% advance seen back in the 1975/76 season.

This increase appears very suspect given the projected index of grain consuming animal units (GCAU) in 2013/14 is 91.4 million units, down from an adjusted 92.1 million units in 2012/13.

There is also an abundance of various by-product feeds such as distillers grains that have displaced corn in the feed rations over the past few years, a trend we do not think will suddenly reverse.

This piece shows the amount of corn fed in bushels per grain consuming animal units vs. the amount of soybean meal fed per high protein animal units.

The USDA’s large increase in projected feed usage is predicated on a 20.8% increase in corn/GCAU, easily the highest ever.

Though corn prices are down substantially from year ago levels they are still above levels seen in 2007, the last time feed usage was this high.

Interestingly, the year-to-year increase in soybean meal usage per high protein animal units is a much more reasonable 2.1%.

Consider also that the heavy using SBM species poultry and pork that are doing much better than the more corn intensive feeding ruminant sector.

(KA)

Comments

To comment, please Log In or Join our Community .