Fundamentally Speaking

Soybean Oil Trading at Historically Low % of Combined Crush Value

Last week, the August soybean meal contract moved to contract highs while August soybean oil traded to new lows.

This very unusual situation is linked to very strong export demand for soybean meal forcing processors to pay record premiums for scarce 2012 soybeans to crush for large outstanding overseas sales still on the books.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybean oil on the other hand has seen demand much more subdued with supplies of vegetable oils quite large particularly for palm oil.

As result, soybean meal now accounts for a historically high percent of the combined crush value from both this product and soybean oil.

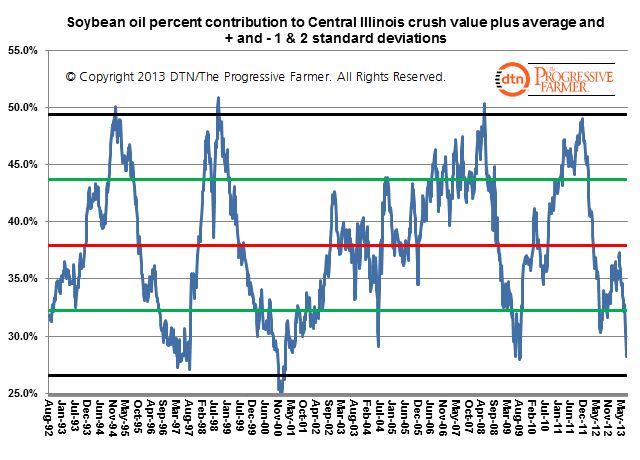

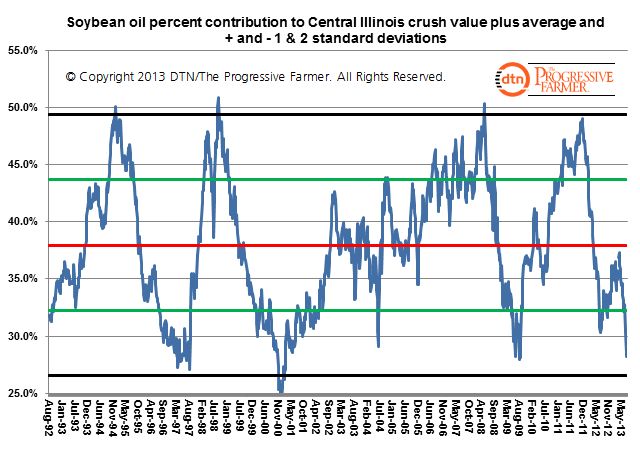

This graphic shows soybean oils’ percent contribution to the combined soybean crush value basis forCentral Illinois.

The chart also plots the average percent of 38.0%, the plus and minus one standard deviation levels respectively at 43.7% and 32.2% and the plus and minus two standard deviation levels of 49.4% and 26.5%.

For only the sixth time since August 1992 the percent that soybean oil contributes to the combined crush value is below the negative one standard deviation line and at the current 28.4% is close to the last major low of 28.1% seen four years ago.

Should soybean meal values continue to escalate, this could put the soyoil percent down close to the negative two standard deviation line that only occurs 2.5% of the time.

There may be a time in the near future where going long soybean oil and short soybean meal may be quite profitable but that may after this year’s tight old crop soybean situation works itself out.

(KA)

Comments

To comment, please Log In or Join our Community .